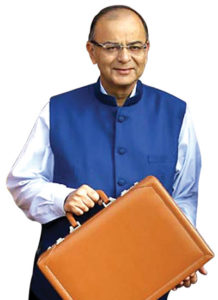

Budget FY19 had few surprises. One could tick all check marks of a union budget before the election. Hence, the focus of the budget was tilted towards vote heavy rural sector and economy. The promise to double farmer’s income is part of the political narrative aimed at getting more vote share in the next general election. In addition to targeting to increase the rural income and improve health through setting of operation green, health protection schemes, other measures such as targeting the allied rural activities like animal husbandry, fisheries and aquaculture by setting up the infrastructure etc. augurs well for the rural sector. What is commendable is that despite the higher expectation from last full-year budget before the General Elections in 2019, the Finance Minister was able to contain himself from doling out any populist measure and worsen the fiscal math.

Nevertheless, what spooked the market was the introduction of long-term capital gain (LTCG) of 10%. The result was fall of more than 5% in following three trading sessions. Part of the fall is also attributed to the global sell-off that we are witnessing currently.

Market Impact

Market Impact

A detail analysis of the announcements made in the budget and its impact on different sectors and company follows –

Agri Sector

Proposal:

- Minimum support price is increased for the even kharif product. It will be 1.5 times Cost of Production.

- Increased target of agriculture credit to `11 trillion.

Impact:

- Will be beneficial for overall rural demand in general and agro-input industry in specific as disposable income in the hands of rural household increases.

- Flow of institutional credit is a key Agri input industry enabler

Companies that might get benefited:

Agro-chem companies like Bayer Crop, Rallis India, DhanukaAgritech, Agri focused piping companies like Finolex Industries, Jain irrigation etc.

Automobile Sector

Proposal:

- Length under Phase I of Bharat Mala program target completion of – 34,800km with financial outlay of `29700 crore.

- Increase in basic customs duty for auto components like gaskets, crankshafts (from 7.5% to 15%), TBR tyres (from 10% to 15%), spark ignition engines (from 7.5% to 15%) and compression engines (from 7.5% to 15%).

- The proposed increase in basic customs duty on completely knocked down (CKD) imports of motor vehicles from 10% to15%, increase in basic customs duty on completely built unit (CBU) from 20% to 25% and other components like (brakes, gearbox, silencers and clutches) of motorcycles

Impact:

- Higher allocation to agriculture and rural sector is going to generate demand for two-wheelers and passenger vehicle. Even higher allocation for infrastructure to AMRUT is going to benefit commercial vehicle demand.

- Increase in custom duty to support domestic auto component manufacturers. Increase in custom duties on CBU/CKD imports of vehicles to also support domestic manufacturers.

Companies that might get benefited:

Tractor manufacturers like M&M, two wheeler manufacturer like HMCL and commercial vehicle manufacturer will get benefited. All tyre companies will also be positively impacted.

Consumer

Proposal:

- No change in taxes on cigarettes

- Increase in customs duty for crude and refined palm oil

- Increase in customs duty on refined safflower oil from 20% to 35%

- Increase in customs duty on orange juices from 30% to 35% and other juices from 30% to 50%

Impact:

- There was no change in GST on cigarettes, which is positive for cigarette companies

- Increase in MSPs for Kharif crops to 1.5x the cost of production, continued government spending on rural and Agri sectors, all of which should help boost consumption.

- Increase in basic customs duty on both crude and refined palm oil will have marginally negative impact on companies like HUL, Godrej Consumer and Britannia.

- Increase in customs duty for juices could affect companies like Dabur particularly.

- Increase in custom duty on various items will increase demand for domestically manufactured goods and reduce competition from cheaper imports.

Companies that might get benefited:

The budget has been neutral for the sector. The overall trend is positive for rural and structural plays. Consumer space, including Britannia, HUL, Page, Emami and Titan are likely to get positively benefited.

Cement

Proposal:

- Allocation for affordable housing through Pradhan Mantri Awas Yojna (PMAY) has been declined by 5% YoY

- Spending toward infrastructure through various road projects has increased by 11% on a yearly basis.

- Increase in cess on customs duty resulting in an overall increase in import duty on petcoke/coal by 0.7%

Impact:

- This sector will get benefit due to rise in allocation toward various infrastructure areas such as roads

- Increase in cess on customs duty from 3% to 10% would result in an overall increase in import duty on petcoke/coal by 0.7%, which will have negligible impact of `5/tonne on EBITDA.

Companies that might get benefited:

The entire cement sector will see its demand increase due to higher spending towards infra.

Capital Goods / Infrastructure

Proposal:

- Overall allocation increased to infrastructure sector by around 21% to `5.9 lakh crore

- Defense capex at `99,600 crore in FY19

- Allocation for railways increased by 14% on a yearly basis to `1.48 lakh crore

- Capital allocation for defense increased by 9% YoY

Impact:

- Higher allocation to infrastructure sector is positive for all the infra and capital goods companies.

Companies that might get benefited:

L&T, Crompton Consumer, Havells, Bharat Electronics, Ashoka and Sadbhav in road infrastructure will get positively impacted. Texmaco and Titagarh will benefit with higher spending in rail infrastructure.

Real Estate

Proposal:

- No adjustments for sale of immovable property shall be made in a case where the circle rate value does not exceed 5% of the consideration.

- Allocation of `27,500 crore in Prime Minister Awas Yojana scheme to build houses in rural and urban area.

Impact:

- This would benefit players across the real estate sector

Companies that might get benefited:

All major listed players will be benefited out of this.

Pharma/Healthcare

Proposal:

- To launch National Health Protection Scheme to cover 10 crore families (50 crore people) with coverage up to `5 lakh per family per year for secondary and tertiary hospitalization.

- Increase in medical expense reimbursement from current `15,000 per year

- No change with respect to claim on input tax credit

- No change in weighted deduction on approved expenditure incurred on R&D activities

- Allocation of `600 crore towards Tuberculosis (TB) treatment

Impact:

- Provide comprehensive health care and free essential drugs and diagnostic services

- Beneficial for hospitals in terms of additional revenues, but may impact adversely due to additional revenue from government schemes

- Neutral for listed domestic pharma players as no major announcement was made

Companies that might get benefited:

Thyrocare Technologies, Narayana Hrudalaya, Apollo Hospitals, Cipla

BFSI

Proposal:

- Setting up of an Affordable Housing Fund (AHF) in NHB funded from a shortfall of PSL with the issuance of fully serviced bonds from the fund

- Encourage corporates to borrow 25% of the borrowing needs from the bond market and permit “A” grade rating as permissible eligibility for investment instead of “AA”.

- Continued budgetary capital infusion in line with Indra Dhanush plan of `10000 crore and recap bonds. Also allow strong RRBs to raise capital for the market.

- Interest income on deposits to be exempted up to `50,000 from earlier `10,000 for senior citizens

- MUDRA scheme lending target increased to `3 lakh crore from `2.44 lakh crore in FY18

- To launch National Health Protection Scheme to cover over 100million poor and vulnerable families

- The deduction limit for health insurance premium increased to `50,000 for senior citizens

- Lending under Pradhan Mantri Mudra Yojana (PMMY) target increased to `3 lakh crore.

Impact:

- Housing companies & housing finance companies to benefit the most as long term borrowings at lower rates, while increasing the supply of housing will propel housing loan growth

- The deeper bond market will negatively impact banks that have a larger share of income coming from corporate banking as it will put pressure on corporate loans

- The national health protection scheme is one of the most ambitious announcement made by government and will give a big boost to general insurance companies.

- The higher deduction limit for health insurance premiums to benefit insurance companies.

Companies that might get benefited:

Positive for general insurance companies like ICICI Lombard, New India and life insurance players like ICICI Prulife, HDFC Life, SBI Life. It might negatively impact banks such as SBI, PNB, Axis and ICICI Bank