Global Economic Reset: Navigating a Shifting Landscape

In this environment, businesses that succeed won’t simply react to change; they’ll anticipate evolving disruptions and proactively adapt their models.

In this environment, businesses that succeed won’t simply react to change; they’ll anticipate evolving disruptions and proactively adapt their models.

The intersection of religious landmarks and economic vitality has long been recognized as a transformative force, transcending boundaries and fostering inclusive growth. With the construction

India’s Interim Budget for the fiscal year 2024 marks a significant milestone in the nation’s economic journey, characterized by a delicate equilibrium between fiscal prudence

In the dynamic landscape of financial advisory, artificial intelligence (AI) has emerged as a pivotal force, revolutionizing the industry by ushering in personalized, data-driven insights

As the year 2023 draws to a close and we are set to step into a new year, it’s time to take a look at

The World Cup serves as a compelling case study for leaders across industries, emphasizing that success stems from a holistic and dynamic approach to leadership.

In the realm of defense, India’s landscape is transforming rapidly. With healthy order books, expanding revenues, and strong governmental support for localization, India’s defense sector

The Indian film industry, often referred to as Bollywood, is one of the largest and most influential in the world. Over the years, it has

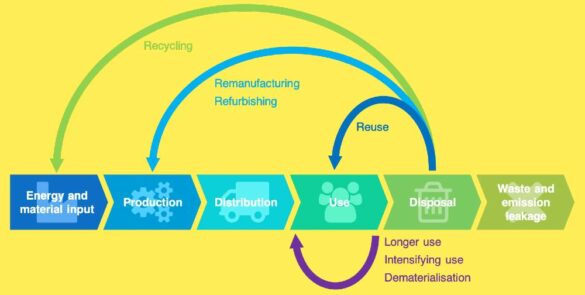

In a resounding response to our planet’s escalating environmental imperatives and a sharpened comprehension of finite resources, the financial landscape is undergoing a transformative upheaval.

The space industry has always been a testament to human ingenuity and perseverance, and India’s ambitious Chandrayaan 3 mission is no exception. While the primary

In today’s nanosecond marketing world, there are rare instances when a campaign transcends boundaries and achieves global success. The latest Barbie movie has undeniably emerged

In the fast-paced and ever-evolving business landscape, companies constantly seek innovative solutions to stay ahead of the curve. However, designing and testing business ideas can