By IE&M Research

Data from various government surveys indicates that the ratio of the number of students who earned higher education degrees to new jobs created had worsened from 9x for the three year period FY11-13 to 27x for FY14-16. Further, as per the latest employment surveys, the job creation at 0.19mn over 9MFY17 is running short of the 8.8mn who graduated in FY16. A report released by JM Financial on the employment scenario in India has come out with such astonishing facts. The report indicates that the gap between demand (for labour) and its supply could increase with the waning job creation in the public sector, manufacturing, IT/ITeS and BFSI. And most importantly, rapid supply of qualified labour with an inherent mismatch in scope.

Report says that based on the quarterly  employment survey and RBI’s data on banking employment, a total of 2.5 mn jobs had been created in nine labour intensive sectors that contribute to over 65% of the GDP in the three year period FY11-13. In the following three year period FY13-15, the corresponding numbers stood at 1 mn jobs. According to the new quarterly employment series, a total of 0.19 mn jobs (excl. banks) were created in the first nine months of FY17. The rate of supply of labour has far exceeded that of demand. Especially of concern is that textiles, IT/BPO and banks, which have contributed to about 90% of these new jobs, are exhibiting signs of increasing sluggishness.

employment survey and RBI’s data on banking employment, a total of 2.5 mn jobs had been created in nine labour intensive sectors that contribute to over 65% of the GDP in the three year period FY11-13. In the following three year period FY13-15, the corresponding numbers stood at 1 mn jobs. According to the new quarterly employment series, a total of 0.19 mn jobs (excl. banks) were created in the first nine months of FY17. The rate of supply of labour has far exceeded that of demand. Especially of concern is that textiles, IT/BPO and banks, which have contributed to about 90% of these new jobs, are exhibiting signs of increasing sluggishness.

Highlighting the difference the report indicates that the private sector had taken over as the primary driver of job creation since 2000 with the ratio of organised public/private jobs falling from 2.4x in FY01 to 1.6x in FY12. The number of central government employees had declined at a compounded annual rate of 2.3%, while private sector jobs reported a CAGR of 3% during this period with finance, insurance and real estate generating employment at the fastest clip (16%). But an increase in labour productivity and the decline in private capex are adversely impacting the ability of the private sector to be the primary driver of job creation going forward.

India’s decade of opportunities

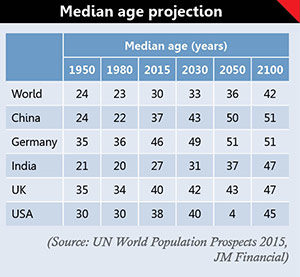

The United Nations Organization reckons India will remain below the global median age for a good part of the next three decades and considerably lower than that of other major economies. The vibrant and younger population is widely expected to be the cornerstone of India’s growth story. However, what is interesting to note is that India has had this benefit earlier as well.

The report’s forecast of the population based on current birth and segment-wise mortality rate provides interesting insights – the youth population (in the age group of 10-24 years) is all set to bottom out and rise at a CAGR of 0.5% during 2027-40; the dependent population above the age of 60 years is expected to rise steadily at a faster CAGR of 2.3% during the same period.

All these factors contribute to a booming labour force. For India to sustain its growth engine, the creation of jobs and absorption of qualified individuals in the system are of paramount importance.