Could active investing on the equity markets become obsolete

With reference to the Renaissance Technologies’ Medallion Fund

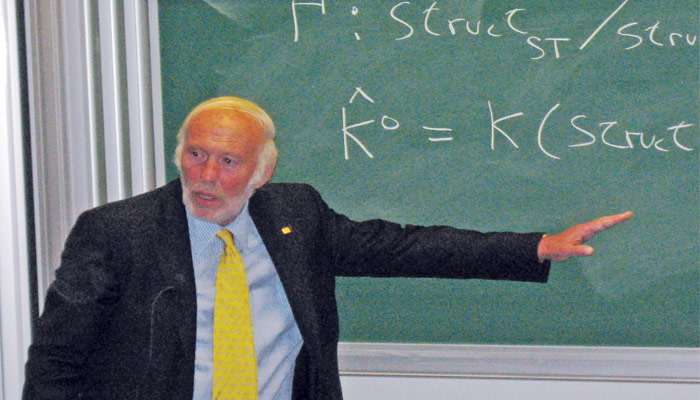

Renaissance Technologies’ Medallion Fund, one of the most successful funds, is known for its intense secrecy. Jim Simons, the winning mathematician who cracked Wall Street, with a genuinely scientific approach is the man behind this success. Surprisingly he does not hire people from business schools or Wall Street; he only hires people who have done good science. Rushin Shah tries to explain here how the world’s most secretive fund makes money. Also as the Medallion Fund has moved toward true machine learning, he encounters another issue whether active investing would become obsolete.

One of the most successful funds in history, Renaissance Technologies’ Medallion Fund, is open only to Renaissance’s roughly 300 employees, about 90 of whom are Ph.D.s, as well as a select few individuals with deep-rooted connections to the firm. The fund, known for its intense secrecy, has produced about $55 billion in profit over the last 28 years, according to data compiled by Bloomberg, making it about $10 billion more profitable than funds run by billionaires Ray Dalio and George Soros. Some peers of Renaissance Technologies’ have closed down the shop or return the money to the clients like Julian Robertson closed down Tiger Management and George Soros scaled back the activities of his Quantum Fund. John Meriwether’s LongTerm Capital Management (LTCM) nearly took down the financial world in 1998. On the other hand, Renaissance Technologies’ consistency has been exceptional over the years. How does Jim Simons, founder of Renaissance Technologies, do it? How Medallion has managed to pump out annualized returns of almost 80 percent a year, before fees? In this article I’m going to try to solve this mystery of mysteries.

Jim Simons and the world of Quants

Medallion’s success, of course, ultimately lies with the people who built, improved upon, and maintain quantitative models. Let’s start with a world-class mathematical mind, Jim Simons. He is a prize-winning mathematician with a genuinely scientific approach to trading and former code breaker. After forming Renaissance, Simons started surrounding himself with like minds. He steadily recruited top-tier scientists. They focused on speeding up systems, studying how to optimize risk allocation and determining trading strategies. Renaissance does not hire people from business schools or Wall Street; they only hire people who have done good science. The headquarters of Renaissance on New York’s Long Island resembles nothing so much as a high-powered think tank or graduate school in math and science. This kind of background gave a totally new approach towards finance!

The goal of quant trading is to build models that find signals hidden in the noise of the markets. Often, they’re just whispers, yet they’ll help predict how the price of a stock or a bond or a commodity might move. Medallion Fund aims to find small market anomalies and inefficiencies that can support profitable trading on billions of dollars of capital. Though all quant funds do the same but Medallion’s approach differs from the “convergence trading” popularized by John Meriwether’s Long-Term Capital Management and similar arbitrage shops. Convergence traders’ price financial instruments based on complex mathematical models, find two different instruments that are cheap and expensive on a relative basis and then buy one and sell the other, betting that the prices will, at some point, have to return to their proper level. Price movements depend on fundamentals and flows and sometimes irrational behavior of people who are doing the buying and selling. The Medallion approach requires that trades pay off in a limited, specified time frame. And Medallion traders never override the models.

Medallion tries to overcome fundamental laws, not discover them. In the case of quantitative finance, the law is the efficient-markets hypothesis and the belief that markets should be difficult, but not impossible, to beat. Medallion believes in the efficient market theory that there are no gross inefficiencies however Medallion looks at anomalies that may be small in size and brief in time. It makes the forecast. Then, shortly thereafter, it re-evaluates the situation and revise its forecast and its portfolio. Medallion does this all day long. Medallion is always in and out and out and in.

The power of Signals

Medallion essentially attempts to predict the future movement of financial instruments, within a specific time frame, using statistical models. The firm searches for something that might be producing anomalies in price movements that can be exploited. In quantitative finance they’re called “signals.” The firm builds trading models that fit the data and produces signals. Renaissance has powerful computers who execute at the lowest cost and without moving markets, crucial requirements for quant funds trading on narrow margins. But the models decide what to buy and sell. “Only in cases of extreme volatility, or if the signals appear to be weakening, the firm sometimes manually cut back. We don’t override the models.” Simons said in an interview with Institutional Investor Magazine.

All trades in the Medallion are made strictly from proprietary, computer-model-driven strategies, which pick from a universe of publicly traded, highly liquid common and preferred stocks and stock index futures used to adjust the overall risk. What is not known are the secrets of the algorithms that can pick stocks smartly enough to beat the market with a portfolio that’s short and long and trade efficiently enough to hold down costs to a bare minimum.

The success lies in data

The success of Medallion doesn’t lie in models but in data! Medallion doesn’t have any preconceived notions. It looks for things that can be replicated thousands of times. The trouble with convergence trading is that you don’t have a time scale. You say that eventually things will come together. Medallion search through historical data looking for anomalous patterns that it would not expect to occur at random. The scheme is to analyze data and markets to test for statistical significance and consistency over time. Medallion creates a layered and layered of statistical tests to confirm the signal is really a new signal.

Signals may eventually go cold over time but will usually be kept around because they can sometimes re-emerge—or have unintended consequences if removed. That’s why positions are held anywhere from seconds to seasons.

AI-driven fund management

In recent years, Renaissance Technologies has recruited few scientists from IBM who were working on speech recognition and machine translation. The firm has moved toward true machine learning, where artificially intelligent systems can analyze large amounts of data at speed and improve themselves through such analysis. Pricing models can be trained on extensive stock market data with signals ranging from news articles to historical price movements. Let’s look at an example of how it can work. Suppose, documents from the Chinese Parliament, for instance, were available only in Mandarin, which none of the scientists could read. The data allowed them to write an algorithm that found the most likely match for the words chuānpǔ or tèlǎngpǔ and Màoyìzhàn which means “Trump and Trade War”. A similar approach applied to speech recognition: Given auditory signal x, the speaker probably said the word “Trade War”. Speech recognition and translation are the intersection of math and computer science.

This kind of AI-driven fund management shouldn’t be confused with high-frequency trading. This is extension of HFTs! It isn’t looking to front-run trades or otherwise makes money from speed of action. Trading speed became necessary but not sufficient to produce differentiated returns. Transaction time that was once measured in seconds is now monitored in nanoseconds. AI and Machine Learning – driven algorithms are looking for the best trades in the longer term—hours, days, weeks, even months into the future. And more to the point, machines – not humans – are choosing the strategy! This will take Medallion to different kind of orbit!

“AI-driven fund management shouldn’t be confused with high-frequency trading (HFT). This is extension of HFTs! It isn’t looking to front-run trades or otherwise makes money from speed of action. Trading speed became necessary but not sufficient to produce differentiated returns.”

What’s next?

Scientists at Renaissance Technologies have also realized that there are diminishing returns to taking on capital due to constraints on deployment opportunities; the Medallion fund is capped at ~$10bn and is closed for new investors since 1993. We believe that after achieving certain scalability on the AI and Machine Learning models, the Medallion fund might reopen for the investors. In that case to deploy new money and to preserve its competitive advantage, Medallion should continue to look at other asset classes and strategies. Since the computers are going to trade with large volumes and human intervention will be totally zero, this can produce unexpected results. Renaissance Technologies should focus on honing monitoring systems that would prevent illogical and extreme trading results.

As we tried to solve the mystery on how the Medallion fund continuously makes higher returns we have identify the new mystery that might need to address in the future. As more funds master the art of AI and machine trading and retail investors become increasingly passive, will we encounter a world in which even the most minor inefficiencies in the market have been arbitraged away? If so, could active investing on the equity markets eventually become obsolete?

(Rushin Shah is the Founder and Managing Partner of management consulting firm Dhanadyaksha Advisors LLP, which works with senior managements of the companies on strategic and operational challenges and organizational opportunities.)