The kind of rebound registered in the market in April has given an impression that now all is well. But that’s not true. Investors should not be fooled by such spurts. People associated with firms who make money out of your trading activities are advocating that there will be a V-shaped economic rebound with a sharp recovery starting in the second half of 2020.

In fact the present market has a historical resemblance with the 1929 market crash and the early 1930s Great Depression which has surprised many market experts. To quote a report circulated widely these days the Dow Jones Industrial Average jumped 500% from August 1921 to September 1929. It then plunged 48% from Sept. 3 to Nov. 13, 1929. To many, that seemed like a reasonable correction of the 1920s exuberance. The 48% stock drop wasn’t exactly unique. The Dow fell 48.5% from January 19, 1906 to January 7, 1907 (almost a year) in conjunction with the Panic of 1907. Still, the economy didn’t collapse and stocks steadily recovered to close at the Dow’s old high by the end of 1909. So stocks rallied 48% until April 17, 1930, representing a 52% retracement. But as the Great Depression unfolded, stockholders bailed out or were sold out, and the Dow fell steadily until July 8, 1932, an 86% swoon and a drop of 89% from the September 1929 top.

On the almost same pattern, the S&P 500 jumped 400% from March 9, 2009 to February 19, 2020. Then, fear of the coronavirus deflated the index by 34% through March 23. But, as investors anticipated control of the virus and the effects of massive monetary and fiscal stimulus, the S&P 500 jumped 32% through April 29, offsetting 53% of the earlier loss.

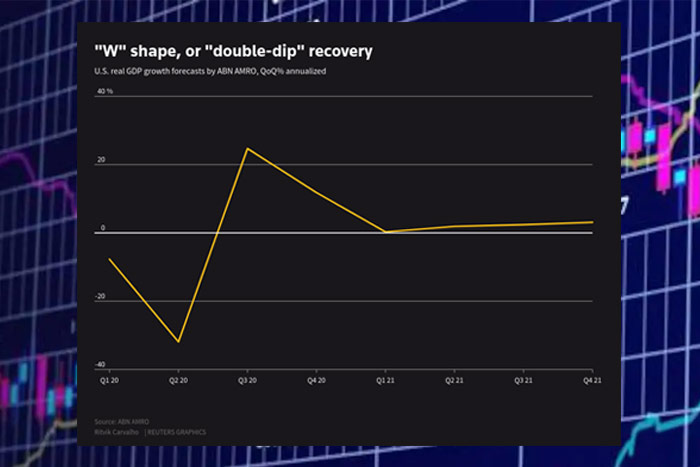

We strongly feel that the present situation is very much similar to that in 1929-30. The markets will fall and will need time to recover because the global recession will not end in months. It may stretch into 2021. However, it has already given and will in future also give enough opportunities to make money.

And that’s what we are presenting to our readers – our recommendations based on Technical Analysis being published in e-Zine Money Multiplier have worked very well as our IE&M Multi-millionaire portfolio.