Based on the index PE multiples, currently the market is most expensive ever. Be careful so you don’t end up buying high.

No one knows what the markets will do tomorrow.  But one can guesstimate what could they do over the next few weeks and months so you can adequately measure the risk and position accordingly.

But one can guesstimate what could they do over the next few weeks and months so you can adequately measure the risk and position accordingly.

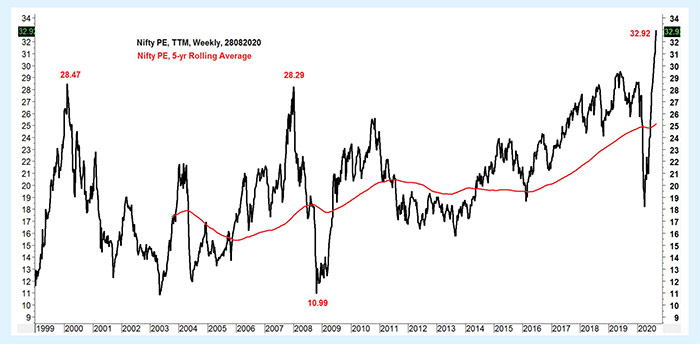

Looks can be deceptive. In the past five months of the policy driven lock-down, when much of the businesses and normal life have come to a standstill, the most followed stock market pivotal – the Nifty 50 index – has recorded the fastest and furiest price expansion on record since this data is available from 1999 onwards.

Though the price earnings ratio (PE) is not be the only criteria to base your judgement about investing in stocks. But it has depicted the risk-reward proposition fairly well in the past and might be a good indicator for the immediately foreseeable future too.

Based on the index PE multiples, currently the market is most expensive ever. Be careful so you don’t end up buying high. Buying at higher levels requires that much longer time period to hold such investments to get at par or profit from it.