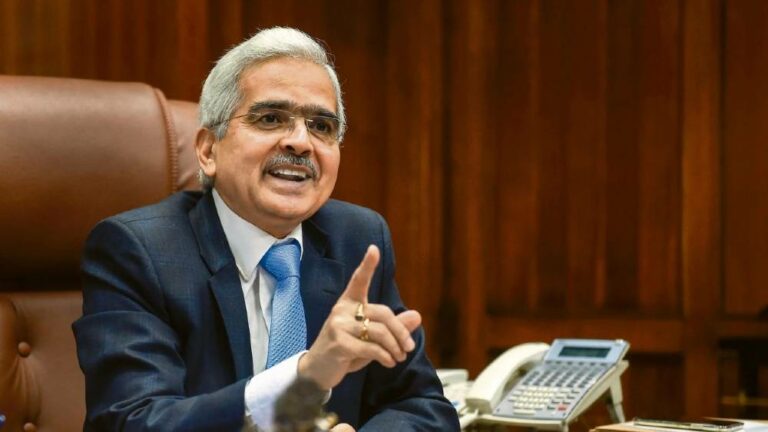

Indian economy should record a growth rate of 7 per cent in the next fiscal and inflation is likely to ease further, RBI Governor Shaktikanta Das said. He also credited the government for structural reforms undertaken in recent years, saying they have boosted the medium and long-term growth prospects of the Indian economy.

He said that amidst a challenging global macroeconomic environment, India presents a picture of growth and stability. Speaking at a CII session on ‘High growth, low risk: The India story’ here during the World Economic Forum Annual Meeting, Das said recent information on the global economic front has been reassuring with inflation falling, though growth remains low.

“Chances of soft landing have improved and markets have reacted positively. However, geopolitical risks and climate risks remain matters of concern,” he said. The Governor said the real GDP growth in India is expected at 7.2 per cent this year. “With strong domestic demand, India remains the fastest growing major economy… We have emerged stronger out of the recent spate of global shocks,” he noted. Das further said that external balance is comfortably manageable with robust foreign exchange reserves.

“Headline inflation has substantially eased from highs of summer of 2022. This shows that our monetary policy action and rebalancing of liquidity is working.

“Core inflation has also gradually and steadily moderated, while proactive supply-side interventions by the government have also played a key role in handling food price shocks,” he said.

Das said he expects average CPI inflation next year to be 4.5 per cent and RBI is committed and confident of achieving the 4 per cent target at the earliest. “We expect the Indian economy to grow by 7 per cent in 2024-25,” he said. The RBI has been tasked by the government to ensure retail inflation remains at 4 per cent with a margin of 2 per cent on either side.

(With inputs from PTI)