This is the question most equity investors have been asking. Unfortunately, no one is able to get a concrete answer to this question. The current rally is largely driven by the pouring liquidity which cannot continue forever. So, it is quite easy to sell a large part of equities and sit on cash. But certain major structural changes happening in the markets and also in the global economy do not allow us to suggest just sell and go away.

The domestic investor base is growing at the fastest rate in history – investors registered on BSE have grown by 46% year-on-year (YoY) and about 2.5 crore investors were added in the last year alone. These incremental investors added in the last one year alone were equal to the overall investor base of the country till a few years ago. In the month of August, almost every working day, one lakh new equity investors got registered on the BSE! This unprecedented growth of new equity investors seems to have some more appetite left to chase the equities in India in the short term.

There are some positive developments on the economic front in the short-term as well:

- Vaccination drive is accelerating and both social and economic activities could become near normal soon in India;

- Both export and import growth rates are impressive and better than what it was during the pre-covid pandemic period (2019). Forex reserves jump substantially due to over $633 billion – the recent allocation of SDRs by the IMF also gives some boost. Rupee might get a further significant boost and the same could lead to more inflows of foreign capital and also discourage any major selling by the FIIs;

- Decent GST collections and auto sales volume despite semiconductor issues, and robust growth in power consumption, and fuel consumption indicate a sustained economic recovery on YoY comparison.

- Rupee gains almost 2% in August 2021 and has emerged as the second-best emerging market currency as FPIs invest $1.1 billion in equities and $1.85 billion in debt;

Global monetary and fiscal stimulus packages announced to tackle the Covid-19 pandemic are cumulatively estimated to be around $23 trillion. Last time, post Lehman crisis, several trillions of dollars were infused into the global economy through stimulus measures which finally led to a massive appreciation of equity asset class across the world with a lag. India too was a beneficiary of substantial inflows in the form of FDIs and also equity investments through secondary markets as well as through PE funds and Venture Capital.

This time too it is inevitable that more foreign capital would come into India – signs are already visible through FDI and PE/VC. China is losing foreign investments in the equity markets. Due to the changing global political scenario, investments by both the FIIs and FDIs could favor Indian markets and assets. It is quite interesting to note that the big foreign PE funds now buy significantly listed securities as well. Thus, Indian equity markets present a big opportunity in the medium to long term in terms of substantial inflows of foreign capital and therefore, significant appreciation of the Indian rupee, which in turn could again strengthen the case for larger inflows of foreign capital.

Thus, developments in both short term and long term indicate more steam left for this market to continue its rally. However, the gap between the overall market caps and liquidity appetite of the secondary stock markets is widening as the markets keep rising. The current overall market cap of the domestic equity market is around Rs. 255 lakh crore!

A major risk to the markets does exist – it would be in the form of puncturing of retail investors’ confidence and subsequent pull out of liquidity from the markets. Even 1% of the total market cap comes for selling suddenly, we don’t have adequate liquidity to absorb the pressures. Mere 1% selling would mean over $30 billion of selling (Rs. 2.50 lakh crore) – no set of market participants have this kind of liquidity to support the markets at the current juncture.

But when will that happen?

It is very difficult to find an answer in terms of any equity fundamentals or economic propositions. Those who thought it would happen soon missed out on opportunities in the last one year.

Since pre-pandemic time (January 2020), the Sensex has gained 41%; however, the BSE Smallcap has gained 99%. The small-cap segment has outperformed the Sensex by 2.4 times! History presents an interesting insight – whenever the small-cap had outperformed the Sensex by more than 100%, subsequently, we saw a severe underperformance by the small caps. Of course, we do agree that history doesn’t become law. However, this trend has a perfectly logical explanation – in such a scenario, relative valuation for the small caps becomes much costlier.

Also, most of the time, short-term investments chase the small caps and the “smart” investors are the first ones to capitalize on the boom in the small caps. Unfortunately, this segment doesn’t have a dominant proportion of investments by institutional investors (FIIs, Banks, Insurance Companies, etc.). Therefore, they tend to underperform severely post such massive outperformance. The 2018 August to January 2020 period was a good example. The Small-cap index underperformed the Sensex by more than 40% and many small and midcap stocks saw 50% to 60% value erosion.

In this background, what should a typical retail investor do?

Now the big question is: In this background, what should a typical retail investor do? The strategy doesn’t call for just selling out all small and midcap (SMC) stocks either. In the recent past, from the listed space, many small and midcap stocks like Mphasis, JB Chemicals, EPL, etc. were lapped up by the foreign investors; in the process, they created substantial equity wealth for the investors. Though SMC stocks hold potential risk in the short-term, quality stocks hold solid medium to long-term wealth creation potential due to the anticipated inflow of substantial foreign capital, thanks to an unprecedented quantum of stimulus measures executed across the world.

In such a tricky situation, it could be wise to think over the following strategies:

- Avoid borrowing and investing in equities – in fact, use the current rally to reduce the existing debt;

- Invest minimum 50% of total equity corpus in the institutional equities i.e., in top 250 stocks in terms of market cap rankings. This segment has a lot of stocks, which have huge institutional participation, which is generally long-term in nature;

- Invest balance 50% in small and midcap stocks, which haven’t participated in this mega rally and also whose thematic stories remain appealing for the long-term; and

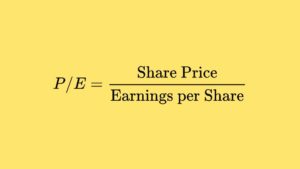

- Lastly but most importantly, do not lose the grip on the quality (management and balance sheet) and valuation comfort of stocks in which you stay invested. Unless there is a strong conviction on 30% to 40% annual profit growth over the next 2 to 3 years, do not pay a premium valuation of 30 to 40 PEs especially in the SMC segment.

In this space, please remember:

- Many managements do not provide adequate confidence on the governance issue;

- Over 95% of stocks suspended from the Indian stock exchanges over the last decade are from this segment;

- Most volatile;

- Unfortunately, there are periods, when the Sensex / NIFTY rewards positively, the SMC segment keeps going down, giving unhappy journey of investment experience;

Considering the inflow of new investors and liquidity, the domestic markets may not see a major fall over the next 3 to 6 months. So, follow 50:50 allocations and stay invested in quality stocks which still give valuation comfort considering the long-term opportunities from the Indian equities. However, be ready at any moment to punch selling to the extent of 20% to 30% of equity corpus – even if it means 5% to 10% losses – if we see any signs of retail / new investors’ confidence in the markets getting punctured in a very big way.

Of course, this task is a difficult one to execute successfully. But it is worth taking this risk in the short-term, as many SMC stocks would give phenomenal wealth creation opportunities in the next 2 to 3 years as we can expect many global funds, including PE funds, chasing several thematic SMC stocks from the secondary stock markets.