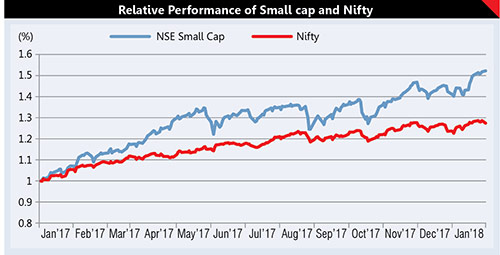

In 2017 the benchmark indices of the Indian equity market has increased by 27%, but Small Cap indices were up by 58%, twice the move witnessed by a large cap indices such as Sensex and Nifty.

A sneak peek at some of the consistently and profitably growing Smallcap Companies

By IE&M Research

The year 2017 will go in the annals of history as one of the best year for equity returns. The total market cap of the Indian equity market increased by 34.5% last year. It is not the front-line indices that have made a large move, it was in fact small cap companies that stole the show. The small cap indices, for the year 2017 were up by 58%, twice the move witnessed by a large cap index such as Sensex and Nifty. Such a performance helped mutual fund schemes dedicated to small cap to generate returns better than the indices. And they remained the best performer among all categories of the mutual funds.

The stupendous rise in the index value of small cap has got reflected in their share of total market cap of the Indian equity market. For example, BSE Small Cap index that contributed around 16.6% of the total market cap of the Indian equity market at the end of January 2016 has now increased to 18.7% of the total market cap. The factors that have helped small cap to outperform is the huge liquidity that is pouring in currently in the equity market. Domestic institutional investors (DII) as well as foreign institutional investors (FII) both are investing heavily in the equity market. Total investment by FIIs in 2017 is close to USD8 billion, which is greater than the sum total of last two years. Even the investment done by DIIs that is local insurers, pension funds and mutual funds in the year 2017 was more than twice that was invested the previous year. Financialization of savings post demonetization has led to such massive buying by domestic investors.

More so it has been observed that domestic investors’ flow is tilted towards the small cap segment, compared with a foreign institutional investor (FII) flows that largely prefer large caps. Therefore, we have seen a sustained and continuous rise in the share price of small cap companies.

Such an outperformance has also led to a higher valuation of small cap companies both in absolute terms and in relative terms. For example, the NSE Small cap index is trading at a price to earnings of more than 100 times, which is almost four times higher than the benchmark indices. Even the BSE Small cap index valuation in terms of price to earnings (PE) is trading 3.3 times the valuation of BSE Sensex. This is up from 2.31 times at the end of FY16. Currently the Sensex is trading at a PE of 23.63x compared to 78.61x traded by BSE Small cap index.

It is an established fact that during the bull run, small cap outperform their larger counterpart. Nevertheless, one should also keep in mind while investing in small cap companies that they are highly risky and probability of loosing capital is more. They are considered suitable for only those investors who have the appetite to absorb higher losses. They are high beta stocks that rise more than the broader market when the market is rising and also suffer a steep fall once the market falls.

The world of small-cap stocks can be a dangerous minefield for the uninformed speculator, but a gold mine for investors willing to do the necessary research to uncover market gems. Since these are under-researched and under-owned stocks therefore they are more prone to wide swings and fluctuation in their prices. For our readers, we have tried to cover most of the ground and bring these 16 small cap companies that have grown consistently and profitably over the years.

Methodology

We started with the entire list of companies that fits into the new definition of Small Cap defined by SEBI in its circular in the month of October. According to which large cap is defined as all the companies with top 100 market cap. After that, next 150 companies will fall into Midcap companies. And small cap companies are those that have a market cap from the 251st company onwards. Therefore, as on December 22, 2017 we took the market cap of all companies and listed them in descending order. We took only those companies that were beyond 250.

We started with 3713 companies that fall under this category. To keep micro companies out of the list we have excluded all the companies that have an annual turnover of less than Rs10 crore for FY17. In this way we were able to exclude 1175 companies and were left with 2538 companies. This was also a huge list to work on.

To find crème de la crème companies among small cap we selected those companies that have exhibited growth both on a yearly basis as well as on a quarterly basis in different parameters.

The first filter that we applied was that companies should be exhibiting continuous growth in topline in last three years. That is, a company must have grown on a yearly basis from FY15-17. It is not only the top line, but also the bottom line matters and hence second filter that we applied is a company’s profit must have grown at least in last two years that is in FY16 and FY17.

After checking the yearly numbers that are at least six months old, we applied another filter on quarterly numbers. In order to check consistency in growth, we compared the first quarter of FY18 results with first quarter of FY17 similarly we did for the second quarter of FY18 to second quarter of FY17.

We checked the growth in three parameters, sales, operating profit and net profit. We took only those companies that have grown in all three levels and recorded a growth of at least 10%.

After applying all these filters, we got total 25 companies. Post this we applied some qualitative and quantitative factors such as outlook of industry and sector where the company is operating, trends in promoter shareholding, volume of trade etc. before zeroing in these 16 companies.

Readers, Indian Economy & Market categorically states here that this is not a recommended list for you to invest, however, you can use it as a starting point to probe further to make any investment. Moreover, these are good companies and consistently growing so the share prices of some companies might have run up. In this scenario, it would be advisable to first understand your own risk profile and investment horizon before you take any decision.

Delta Corp Limited

- Delta Corp (Delta) is India’s only listed player in the organized gaming space. The company operates casinos in Goa and Sikkim. The acquisition of adda52.com in FY17 marked Delta’s entry into online gaming, a huge but yet untapped market.

- As per Q2FY18, the company derives 77% of consolidated revenue from casino gaming, 13% from online gaming and 10% from hospitality division.

- There are two main triggers for Delta i.e. approval of Daman casino and revenue accretion from online poker site adda52.com (acquired in FY18 for Rs 200 crore).

KEI Industries

- KEI is one of the leading manufacturers of cables and wires in India. For FY17, it derived 82% of revenue from cables and wires business, 14% from turnkey projects and 4% from the stainless steel wire segment. In cable, LT power/rubber cable is a major contributor to company’s revenue (41%).

- The company has a strong distribution network. Currently it has 926 distribution network.

- Positive investment outlook in power and distribution business is expected to trigger demand for the company’s products. Besides, government’s rural electrification target of reaching 18,452 villages by FY18E is expected to aid demand for its products.

Manpasand Beverages

- Manpasand Beverages (MBL), is a leading manufacturer of fruit drinks in India and ‘Mango Sip’ remains MBL’s flagship product and it contributed around 73% to MBL’s FY17 revenue.

- The company is diversifying its product portfolio and has added products ‘Fruits Up’ and ‘Manpasand ORS’. The company is also planning to launch a new drink under brand name ‘Sizenal’ containing a mix of fruits and vegetables and uses honey instead of sugar.

- MBL plans to set-up three manufacturing plants in Vadodara, Varanasi and Eastern region. The Vadodara plant is expected to commence operations by end of FY18E and Varanasi and Sri-city plants by Q1FY19E.

Capital First

- Capital First is an NBFC engaged in providing debt financing to MSMEs and consumers. Its AUM at the end of FY17 stood at around Rs19800 crore.

- In FY17 company had 93% exposure to retail loan and 7% to wholesale. Two-wheeler business grew at 44% and consumer durable at 62% on a yearly basis in FY17.

- Its GNPA and NNPA stood at ~0.95% and ~0.3% respectively.

Pincon Spirit

- Pincon Spirit (PSL) is a leading IMFL (India Made Foreign Liquor) and IMIL (India Made Indian Liquor) player in the eastern part of India. In the IMIL segment, the company is engaged in blending, bottling and wholesale distribution of its own product, PINCON Bangla No. 1, Bengal Tiger and Uddan in West Bengal.

- The company manages and controls 43 retail IMFL outlets in West Bengal. In the company’s FMCG segment, it sells edible Oil (Mustard Oil, Soya Oil and Rice Bran Oil) under Pincon and King’s Coin brand.

- Growing acceptance of the company’s brand of portfolio, deeper penetration in existing territories and expansion in newer areas will drive volume growth of the company’s product.

Alankit Ltd.

- Alankit Ltd. is a part of the Alankit Group, which is engaged in e-governance, financial services, insurance and healthcare verticals. However, Alankit is engaged in the business of e-governance and e-governance products. It provides services like UID, enrollment, PVC Aadhaar Card, scanning and digitization of medical reports etc.

- The company is a chief beneficiary of government’s increased effort to move many of the compliance digitally. Alankit remains one of the key players in providing such services. It has already acquired 40% market share in direct tax compliance.

- All this is already reflected in company’s financial performance. The company has shown a sharp improvement in its revenue and profitability since FY14. Company’s revenue has increased at an astounding pace of 273% annually.

8K Miles Software Services

- 8K Miles Software Services is a niche IT player specialising in cloud services. It has comprehensive domain-depth and wide range of services and solutions encompassing every aspect of Cloud – from Identity Access to Analytics to UI/UX and Big Data.

- Launched ‘Automaton’ a new product that offers automation of cloud operations (AWS, Azure) and also, brings Artificial Intelligence and Machine learning capabilities to cloud managed services.

- The company is expected to achieve its near-term revenue target of USD200 in next two years, which means more than doubling of FY17 revenue.

Akme Star Housing Finance

- Akme Star Housing Finance was originally incorporated as “Akme Buildhome Private Ltd”. The company is engaged in to manage, administer and to carry on the business of providing housing loans, funds for the construction of houses and loan against home properties.

- ‘Housing for All by 2022’ to provide Akme Star Housing Finance the required impetus to grow its business.

- Company has maintained strong financials. Its Capital Adequacy Ratio is at 109.00 % as on March 31, 2017, which provides an adequate cushion to withstand business risks and is above the minimum requirement of 12% stipulated by the National Housing Bank. Its gross NPA and net NPA in the same period stood at 1.56% and 1.06% respectively.

India Home Loan

- India Home Loan Limited (IHLL) incorporated as ‘Manoj Housing Finance Company’ is a housing finance company offering retail home loan products for an affordable housing segment.

- The company’s portfolio consists of Rs29.63 crore as of 31st March, 2017 (previous year Rs23.17 crore) for home purchase and construction in the retail home loan segment. While its portfolio is Rs12.58 crore (previous year Rs8.24 crore) for mortgage loans and builder loans for long term housing projects.

- IHLL made a provision of INR58.30 lakh and Gross NPAs are 2.71% and Net NPAs are 1.94% on the outstanding loans of INR42.21 crore as on March 31st, 2017. Showing a strong risk management practice, IHLL has made excess provision of Rs5.28 lakh as contingencies.

Navin Fluorine International

- Navin Fluorine International is a part of Arvind Mafatlal Group in India. The company primarily focuses on three businesses, refrigeration gases, chemicals/ bulk fluorides and specialty organofluorines with manufacturing facilities at Surat, Gujarat and Dewas, Madhya Pradesh. It is largest integrated specialty fluorochemical company in India.

- For FY17, the company’s total share of revenue was contributed by Refrigerants (31%), Inorganic Fluorides (17%), CRAMS (20%) and Specialty Chemicals (33%).

- Continuous dividend paying company since last 10 years with pay-out ratio of around 30% of profit after tax.

RPP Infra Projects

- P.P infra projects is infra company operating through JV partners and with an asset light business model. It has integrated business presence, including conceptualization, conceive, construction and commission infrastructure assets.

- Consistent margin growth on an account of larger project size, cost control, and prudent financial modelling.

- Significant presence in South India through 16 concurrent operational sites in 3 states and has an order book of Rs807.92 crore at the end of June 2017, giving good earnings visibility.

SRG Housing Finance

- The company was started as Vitalise Finlease Private Limited in year 1999 and is engaged into individual home loans, loan against property and project loan. Housing loan constitutes 77.94% of the total portfolio, LAP forms 13.4% and project loan consists of 8.6% for September 2017.

- Company’s asset under management (AUM) has grown at a CAGR of 69.82% since FY12 and stood at Rs125.04 crore at the end of September 2017.

- Going forward, the company plans to expand its branch network in North West Region of the country. Focus areas of the company will be Tier II & Tier III cities of Rajasthan, Maharashtra, Gujarat and Madhya Pradesh.

Virnchi

- Virinchi is a Hyderabad headquartered company operating its business in three verticals namely IT Products, IT Services and Healthcare. For Q2FY18, IT Products contributed 39% of total revenue while IT Services shared 32% and 29% of revenue respectively.

- The EBITDA margin of the company remained at a healthy level of 27.1% for Q2FY18. This is going to increase once their healthcare business, which they launched in November 2016 matures.

- Going forward, the company plans to build efficiency and capabilities in their quest to serve one billion patients. In IT services and product company plans to add new products in USA and India.

V2 Retail

- V2 Retail Limited is a retail company engaged in the business of retail sales of garments, textiles, accessories and consumer durables products in India. It has 38 operational stores in India spreads across 13 states in India. The company plans to increase it to 100 in next 3 years.

- V2 Retail’s 44% of its sales from men’s wear, 27% from women’s wear, 26% from kids’ wear and 3% from lifestyle products. Ethnic wear accounts for 8%-10% of total sales of the company.

- The company expects sales to post a CAGR of 40%-50% over the next five years with sustainable operating margin of 10%-11%. Part of the margin increase will be through increased private labels in the revenue mix to 30% in 12 months.

Safari Industries (India)

- Safari Industries (India) is engaged in manufacturing and trading of luggage travel goods. The Company’s product range includes polycarbonate (PC) zippered luggage. It also offers products under various categories, such as laptop bags and backpacks.

- The company earns significant part of the revenue from the Canteen Stores Department, CSD as it is commonly referred to. The company follows an asset light model as it imports products from China and sells under its own brand name.

- The company has both offline and online presence. It has a distribution network across 15 states in India with about 600 dealers, besides selling through tie-ups with Modern Retail and E-retail.

Sreeleathers Limited

- Sreeleathers is engaged in the business of dealing in all kinds of footwear and leather accessories. The Company has around 30 retail outlets (including outlets owned by franchise), spread over nine states, including West Bengal, Bihar and Jharkhand.

- Company’s sales has increased by 20% annually in last three years ending FY17. The profit of the company has increased by 25% annually during the same period.

- The company is virtually debt free and has witnessed continuous improvement in its ROCE and RoNW in last four years ending FY17.