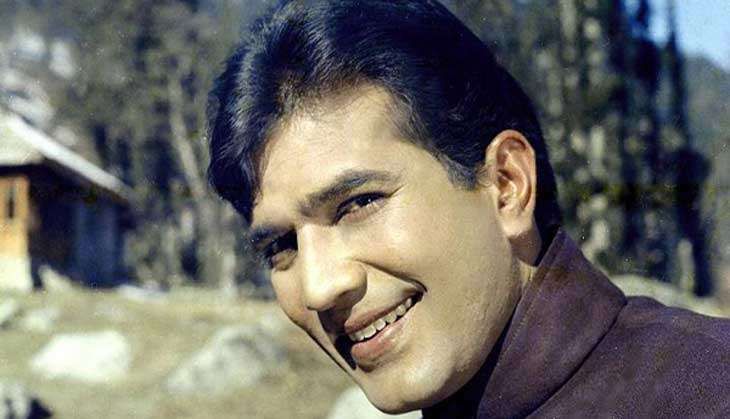

Film actor Rajesh Khanna bought an iconic bungalow on Carter  Road in Mumbai for Rs 3.5 lakhs in 1970. His heirs sold it recently for Rs 85 crores. The property has multiplied by 2428 times or an annualized return of 19.38% over 44 years.

Road in Mumbai for Rs 3.5 lakhs in 1970. His heirs sold it recently for Rs 85 crores. The property has multiplied by 2428 times or an annualized return of 19.38% over 44 years.

Samudhra Mahal in Mumbai is another expensive property. A flat purchased in 1970 at Rs 700 per sq.ft was sold at Rs 1,18,000 per sq.ft in 2013. Money multiplied by 168 times in 43 years. This works out to an annualized return of 12.66%.

purchased in 1970 at Rs 700 per sq.ft was sold at Rs 1,18,000 per sq.ft in 2013. Money multiplied by 168 times in 43 years. This works out to an annualized return of 12.66%.

In 1963, Godrej paid Rs one lakh to buy his first house,  a 2916 sq.feet apartment at Usha Kiran, Carmichael Road, in tony South Mumbai. In 2011 he sold it for Rs 25 crore. Money multiplied by 2500 times over 48 years or an annualized return of 17.70%.

a 2916 sq.feet apartment at Usha Kiran, Carmichael Road, in tony South Mumbai. In 2011 he sold it for Rs 25 crore. Money multiplied by 2500 times over 48 years or an annualized return of 17.70%.

In Dalal Street, Mumbai a sq.feet was Rs100 in 1980. After 34 years, it sells at Rs 27,000 per sq.ft. Money multiplied by 270 times in 33 years. This works out to an annualized return of 17.90%.

In Dalal Street, Mumbai a sq.feet was Rs100 in 1980. After 34 years, it sells at Rs 27,000 per sq.ft. Money multiplied by 270 times in 33 years. This works out to an annualized return of 17.90%.

The first three properties can be bought and owned by cream or elite of the society who are worth at least tens of crores, mostly hundreds of crores. The last property in Dalal street; your father could have bought with whatever money available at his disposal. You can buy it even now. Your son or daughter would be able to buy it even 20 years down the line.

The last property is Sensex. A sq.feet is a metaphor for one unit. If dividend yield is also included (assuming 2% CAGR), Sensex would have delivered 20% annualized returns over last 34 years, higher than the most expensive prime properties in the country. Good mutual funds and many stocks have delivered returns far superior to Sensex itself.

Power of equity is least understood in this country.

If you can withstand the notional loss (if you don’t book) in the portfolio during bear markets, not worry about daily price movements, it is possible to make much better money than what can be made out of the best of real estate. At least give the same importance to equity as you give to real estate. You don’t mind holding real estate for 20 or 30 years. Please do the same for equity ignoring bull and bear markets, notional profits and losses.

Many of you have been investing for the last couple of years. Stay the course for at least another 15 to 20 years completely ignoring market fluctuations. You would be amazed at the fortune created for your retirement or to pass on to your children.