Will technology be a saviour?

By Ranjini & Rajdeep Bhatia

Every business thrives on cash or the availability of cash in easy terms whenever the firm needs it. Firms are constantly looking for ways to access cash at reasonable terms or postpone payment to creditors. Suppliers, on the other hand are looking at ways to reduce the cash cycle and augment their working capital. This tension between the buyer, who wants flexible payment terms and the supplier, who wants a shorter cash cycle, creates the need for what is popularly known as “supply chain finance” management. As physical supply chains have become more and more optimised, firms find it harder to realise savings by managing these. This has prompted supply chain managers to focus their attention to the financial flows along the Supply Chain (SC) which form an essential part of the continuum of the business operation. Hence businesses today attempt to optimize the financial flows along the supply chain, more popularly known as “Supply Chain Finance” (SCF) management.

The term “supply chain finance” has been  used in relation to the management of cash flows and financial processes in supply chain. Thus, financial supply chain management is defined as the “optimized planning, managing, and controlling of supply chain cash flows to facilitate efficient supply chain material flows”. SCF is also defined as a set of business and financing practices that form the connections between various parties in a transaction – buyer, seller and financing institution – in order to lower financing costs and improve business efficiency by streamlining working capital management. SCF could simply be about working capital management or could encompass the flow of cash between corporations along the supply chain either in the form of a transactional payment between a vendor and a buyer or in the form of finance. The finance can be either from a bank or a financial institution or from a supply chain partner willing to lend in the form of an early or extended payment. SCF can also be viewed as implementing the set of financial instruments that enhance the cash utilization in supply chain. It usually involves “the use of financial instruments, practices, and technologies to optimize the management of working capital, liquidity, and risk tied up in supply chain processes for collaborating business partners”(Euro Banking Association,2014). Since supply chain involves multiple entities, there is immense potential for value creation by integration of financing processes with customers, suppliers, and service providers in order to increase the value to all participating entities.

used in relation to the management of cash flows and financial processes in supply chain. Thus, financial supply chain management is defined as the “optimized planning, managing, and controlling of supply chain cash flows to facilitate efficient supply chain material flows”. SCF is also defined as a set of business and financing practices that form the connections between various parties in a transaction – buyer, seller and financing institution – in order to lower financing costs and improve business efficiency by streamlining working capital management. SCF could simply be about working capital management or could encompass the flow of cash between corporations along the supply chain either in the form of a transactional payment between a vendor and a buyer or in the form of finance. The finance can be either from a bank or a financial institution or from a supply chain partner willing to lend in the form of an early or extended payment. SCF can also be viewed as implementing the set of financial instruments that enhance the cash utilization in supply chain. It usually involves “the use of financial instruments, practices, and technologies to optimize the management of working capital, liquidity, and risk tied up in supply chain processes for collaborating business partners”(Euro Banking Association,2014). Since supply chain involves multiple entities, there is immense potential for value creation by integration of financing processes with customers, suppliers, and service providers in order to increase the value to all participating entities.

Management of finance has been traditionally limited to firm specific strategies. Working capital management, in particular, has been predominantly focused on delaying payment to suppliers, hence avoiding dependence on traditional external equity and debt financing. Such delay in payment has had undesirable consequences, especially for the small and medium enterprises. It has resulted in serious cash flow issues for such firms and the consequences of this for material flows in supply chains are manifold, with upstream supply chain enhancing financial risk leaving suppliers with no options but to increase price or, where that is not feasible, degrade quality of supply. This focus on individual firms contradicts the basic paradigm of supply chain management (SCM), which stresses that companies no longer compete as solely autonomous entities, but rather as supply chains. Persistent working capital issues as discussed so far, especially in the context of small and medium enterprises, requires newer strategies that recognize the power of value creation by better integration of processes between participants in a supply chain.

Credit crunch has become an essential feature post the global economic crisis and not just corporates, even banks are eager to make maximum use of their limited capital stretch. While on the one hand firms have to think as supply chains rather than as insulated entities, banks on the other hand are forced to extend their credit reach by creating unconventional solutions that will help mitigate their lending risk. It is in this context that we discuss SCF solutions that could help mitigate the credit problems of suppliers, while unleashing value for all players in the supply chain.

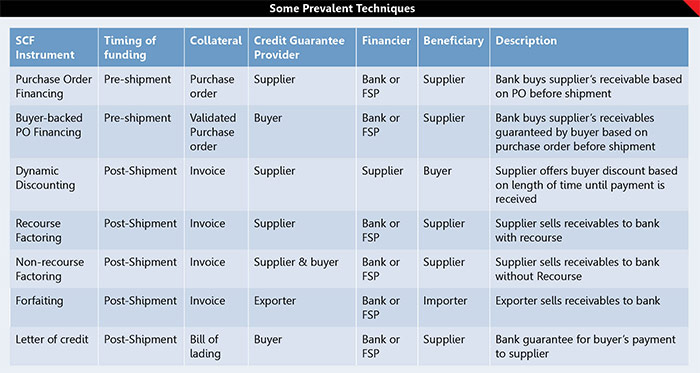

Some of the commonly known supply chains financing instruments are bill discounting or warehouse receipt finance. In such cases, the bank steps in and funds the working capital gap by charging a discounting fee against firm orders which have been billed or against warehouse receipts. Another common technique is called reverse factoring in which the lender purchases accounts receivables only from transparent, high-quality buyers. Sometimes, inventory which has been shipped and is in transit is funded by the lender secured by pledging the inventory. A simple trade credit, on the other hand is an arrangement between the buyer and seller, wherein supplier offers buyer early payment discount and charges interest on extended payment terms. The following table offers a glimpse of a few other prevalent techniques:

While these traditional tools fix the working capital problem, these are still largely unable to satisfy the demand for timely funding. Firms that do not have access to bank funding use fixed assets such as property as collateral for borrowing. External events such as the one witnessed in India recently, namely the collapse of IL&FS; an infrastructure finance company creates a crisis of confidence. Events such as these almost instantly cause the borrowing costs to rise hurting every firm equally. However, large, publicly traded companies, respond to tough times by shortening their own working capital cycle by lengthening it for their suppliers, namely, the smaller firms. This hurts small firms substantially because they have to borrow at higher cost from banks. Even non-bank lenders, who are more flexible in lending to small firms, require clarity in financial projections, documentation, current and fixed assets to be able to decide quantum of working capital requirements vis-a-vis long term loan requirements of the SME, which many of them are unable to provide.

The more modern and unconventional tools for supply chain financing uses technology interface to connect the bank and the players in the supply chain. One such example is the Receivables Exchange of India Ltd (RXIL) which was incorporated on February 25, 2016 as a joint venture between Small Industries Development Bank of India (SIDBI) – the apex financial institution for promotion and financing of MSMEs in India and National Stock Exchange of India Limited (NSE) – premier stock exchange in India. RXIL operates the Trade Receivables Discounting System (TReDS) Platform as per the TReDS guideline issued by Reserve Bank of India. It is an electronic platform that allows auctioning of trade receivable. The process is also commonly known as ‘bills discounting’, wherein, a financier (typically a bank) buys a bill (trade receivable) from a seller of goods before it is due or before the buyer credits the value of the bill. In other words, a seller gets credit against a bill which is due to him at a later date. The discount is the interest paid to the financier.

The process starts with seller uploading the invoice on the platform. It then goes to buyer for acceptance. Once the buyer accepts, the invoice is then factored and becomes factoring unit. The factoring unit then goes for auction. The financiers then enter their discounting (finance) rate. The seller or buyer, whoever is bearing the interest (financing) cost, gets to accept the final bid. TReDs then settle the trade by debiting the financier and paying the seller. The amount gets credited the next working day into the seller’s designated bank account through an electronic payment mode. The second leg of the settlement is when the financier makes the repayment and the amount is repaid to the financier. As per RBI TReDS guidelines, only MSMEs can participate as sellers, while banks, non-banking financial companies and factoring companies are permitted as financiers. (More details on http://www.rxil.in/Home/Index)

These technologies enabled platforms give the opportunity for firms to discover borrowing costs through a transparent process. SCF is new emerging opportunity for banks and fintech companies. Traditionally dominated by banks, the market has more recently been entered by fintechs: specialist financial technology companies that provide platforms and software-based services to support SCF operations. SCF is a big business, with $2 trillion in financeable highly secure payables globally and a potential revenue pool of $20 billion as estimated by Mckinsey. Revenue has grown at 20 percent per year since 2010 and is expected to continue growing at around 15 percent for the next three to five years. Revenue pools are largest in Europe and the United States, but buyer programs are growing rapidly in Asia and Latin America. Thus, SCF represents a win-win opportunity for all participants. This leaves us with an important question: Are firms willing to try out the newer SCF options? Are firms technology-ready to adopt such solutions? Do firms accord any importance to SCF management? Are small and medium enterprises willing to consider technology driven solutions for their funding requirements?

(In the next part of the series, we explore the answers to the questions we have raised in this article. We ran a detailed survey to understand various SCF tools implemented by companies. We floated a questionnaire among companies and 16 companies responded to our questionnaire. Our key purpose was to get first hand perception of SCF among the companies and to see if technology infusion has changed the way of working of SCF.)