The enhanced surveillance measure for micro and small-cap companies, put in place by the market regulator and exchanges from June 5, is in fact unfairly targeting one segment of the stocks. The new measure will cover companies on the main board with market cap less than Rs 500 crore and will be effected in two stages. For both stages, the companies will be shortlisted based on variations in high and low prices, or in close-to-close prices. For stage one or ESM-I, price variations over three to six months will be considered. In stage two or ESM-II, companies already in stage one and significant price variations over five consecutive trading days or over one month will be included. The surveillance mechanism should allow for trading of stocks and what if somebody wants to sell due to various reasons. The best practice would have been that the regulators penalise only the errant players whereas this action even penalises investors.

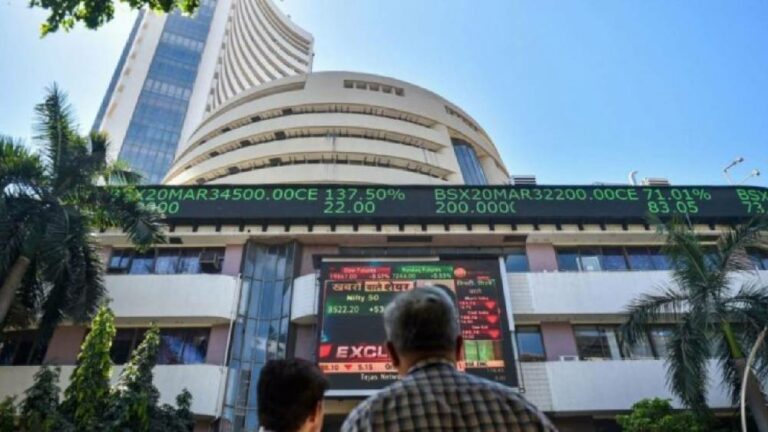

To improve market reliability and protect the welfare of investors, the regulator of the capital market in India, the Securities and Exchange Board of India (SEBI), and stock exchanges Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) have been hosting numerous superior preventive surveillance actions namely a reduction in price band, transfer of securities to Trade for Trade segment and periodic call auction from time to time.

In addition to several surveillance actions by now put into action, the SEBI and stock exchanges, according to debates in joint surveillance summits, have decided that together with the aforementioned actions there shall be Enhanced Surveillance Measures (ESM) on Micro-Small Companies (on main board with market capitalization below ₹500 crores) based on objective parameters such as Price variation, Standard Deviation, etc. The framework to prevent volatility in small-cap counters is applicable from June 5, 2023.

Know your ESM

According to the announcement, public sector organizations and public sector banks will be exempted from the procedure of shortlisting securities under ESM. The securities will be chosen under the ESM framework based on high-low price variation and close-to-close price variation. The recognition of securities based on entry norms will be 100% margin from the settlement cycle of the trade date plus two days (T+2). As per the notification, the trading for these securities will be settled through a trade-for-trade mechanism with a price band of 5% (if the scrip is already in the 2% band) or 2%. For securities already in stage I, trading will be allowed once a week with periodic call auctions. The trading for these securities will be settled through a trade-for-trade mechanism with a price band of 2%. The notification stated that stage-wise scrutiny of securities will be weekly.

Under the system, security shall be part of the framework for a minimum period of 90 calendar days. However, in case a security is under stage II of the Framework, it shall be retained under stage 2 for a minimum period of 30 calendar days. After completion of 30 calendar days, in weekly stage review, if such security’s close-to-close price variation is less than 8% in a month, it can move to stage 1 of the framework. After the end of 90 calendar days, in a weekly stage examination, if such a security’s close-to-close price variation is less than 8% in a month, it can move to Stage I of the ESM framework. The securities that complete three months in the framework shall be qualified for stage-wise exit if they no longer meet the entry standards.

Recently the SEBI issued a consultation paper that recommended price band formulation for scrips in futures and options (F&O) trading to toughen volatility management and reduce information irregularity. As per the consultation paper, the capital markets regulator has given suggestions to prevent longer trading hours as well as price movements. According to the recommendation, the SEBI mentioned that if the price of any stock falls and rises by 10% in one session, the trading is to be barred for an hour, instead of the existing cooling-off period of 15 minutes. The development comes in the wake of the free-fall of Adani Group stocks after the U.S. short-seller alleged the port-to-energy conglomerate of stock market manipulation.

The consultation paper also suggested the creation of sufficient surveillance and internal control systems (collectively referred to as Institutional Mechanism) by Asset Management Companies (AMCs) to discourage probable market misuse and deceitful transactions in such transactions. The decision was taken months after the capital markets regulator barred 21 entities including Viresh Joshi, Axis Mutual Fund’s former manager, concerning a front-running case in March 2023. In May 2023, SEBI barred three individuals and two entities concerning the front-running case in Life Insurance Corporation (LIC).

Brainless Belief

The benchmarks to place a company’s shares in the ESM framework are only price action dependent and do not take into thought the principal business fundamentals. It would frequently mean that the businesses showing excellent business functioning would be punished for doing their business well. The framework will influence different sectors of the market adversely.

The framework will lead to a huge shrinking of liquidity in authentically worthy microcap stocks. It will make retail investors reluctant from partaking in the equity market, especially in the small and microcap area.

The share price will go out of sync with business fundamentals and it will make fundraising very tough for the minor entities as High Net Worth Individual (HNI) interest will also descend, as there is an extra danger they will have to pilot through, in addition to the business risk that they would have otherwise been comfortable taking. As companies now have fewer funds at their disposal, their forthcoming strategies for capital expenditure for capacity development or other modes to flourish their business would be quite harmfully affected. Less capital expenditure would also result in lower employment generation. As goods supplied or services delivered would confront supply restraints due to capital constraints, this would also have negative consequences on the economic progression of the nation.

Investors who have their money invested in the microcap space will find it difficult to dispose of their holdings and get their money back because of a lack of liquidity. It will brutally influence investors in case they need money in case of any difficulties.

Need a Fundamental Mechanism

- The gloomy framework has to be redesigned. The remedy is a fine equilibrium of regulations and investment ecology. Once the quantitative tactics are executed, it has to be verified that each of such companies which match the standards for the ESM framework is overvalued.

- One method to estimate if a company is overvalued is by looking at its Trailing 12-month Price to Earnings (TTM PE) ratio. A cut-off (say of 100 or any other number) should be decided and only those companies where the TTM PE is more than that number should be shifted to the ESM framework. It will assist the related authority to have a word with the company’s management regarding why the price has shot up lately and if there are elementary reasons for the same. It will immensely diminish the number of mistakes where good and genuine stocks are moved to ESM.

- There are numerous business circumstances namely takeovers, capital raising, etc. which may initiate appreciation in the price of a stock. Those stocks where publicly available information and filings validate the price increase should be left out of the framework.

- Once the elementary motivated and corporate action-driven mechanism is employed, there would be few stocks that are moving up without any motive and the reason is not available in the public domain. Such stocks can be subjected to the ESM as there is a high chance that either the stocks are moving up due to material non-public price-sensitive information or these stocks are being subjected to price manipulation by select market members.

- Significant non-public price delicate data and manipulation both should be constrained. It will guarantee a level playing field for retail investors and ensure investor safety due to manipulation. For that reason, the best foot forward is to make modifications to the ESM framework where fundamentals and corporate actions also play an equally imperative role. It will lead to multi-purpose action of stopping stock price manipulation as well as reinstating trust of retail investors in the system, empowering businesses to thrive, as well as macro implications of employment generation and economic evolution.