During the first quarter of 2023, investors around the world exhibited contrasting attitudes towards banking stocks. While those in the US and Europe remained cautious, investors in India continued to show great interest and enthusiasm for the banking sector. Despite the challenges faced by banks in developed economies, the Indian banking system stood out due to its robust balance sheet, diverse portfolio, and notably lower bad loans. The sector’s sound health was reflected in strong capital and liquidity positions, improved asset quality, better provisioning coverage, and enhanced profitability.

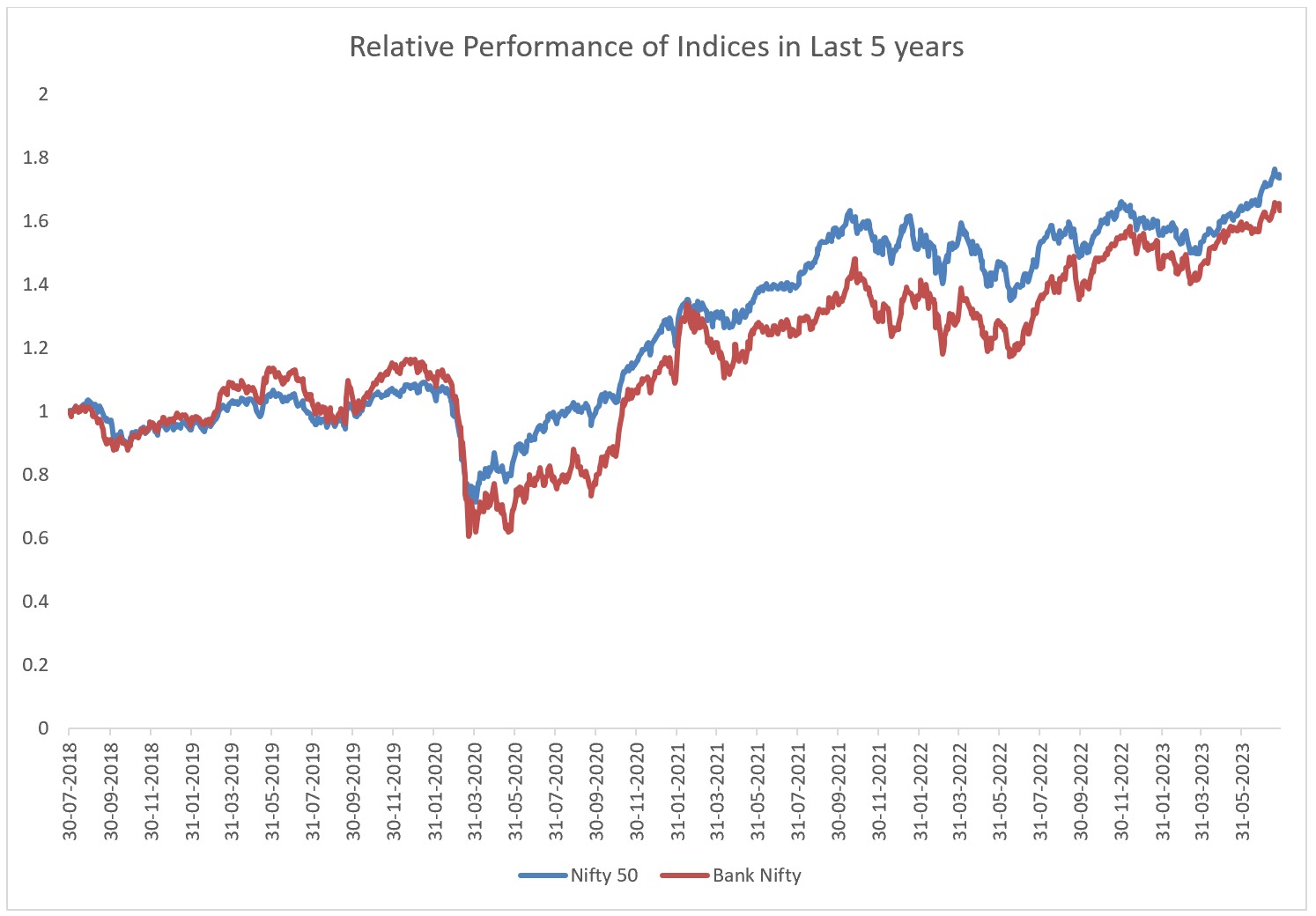

This optimism towards Indian banks was well-founded, as evidenced by the outperformance of the Bank Nifty index compared to the Nifty 50. Over the past one year, both Bank Nifty and Nifty 50 have delivered impressive returns, showcasing their resilience and ability to capitalize on market opportunities. Bank Nifty, which tracks the performance of the banking sector, recorded a commendable growth of 20 per cent, while Nifty 50, representing the broader market, achieved a solid 13 per cent return.

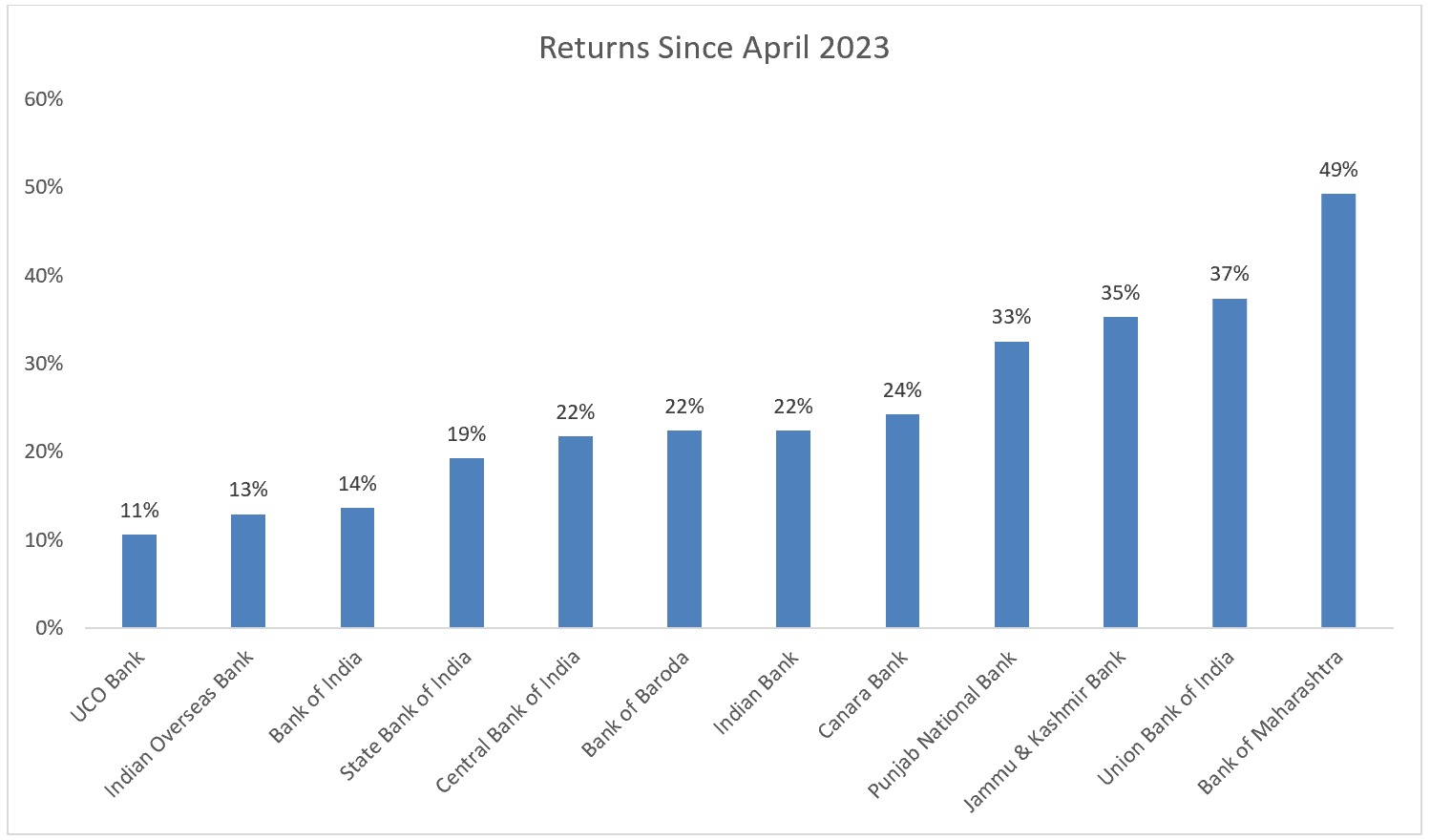

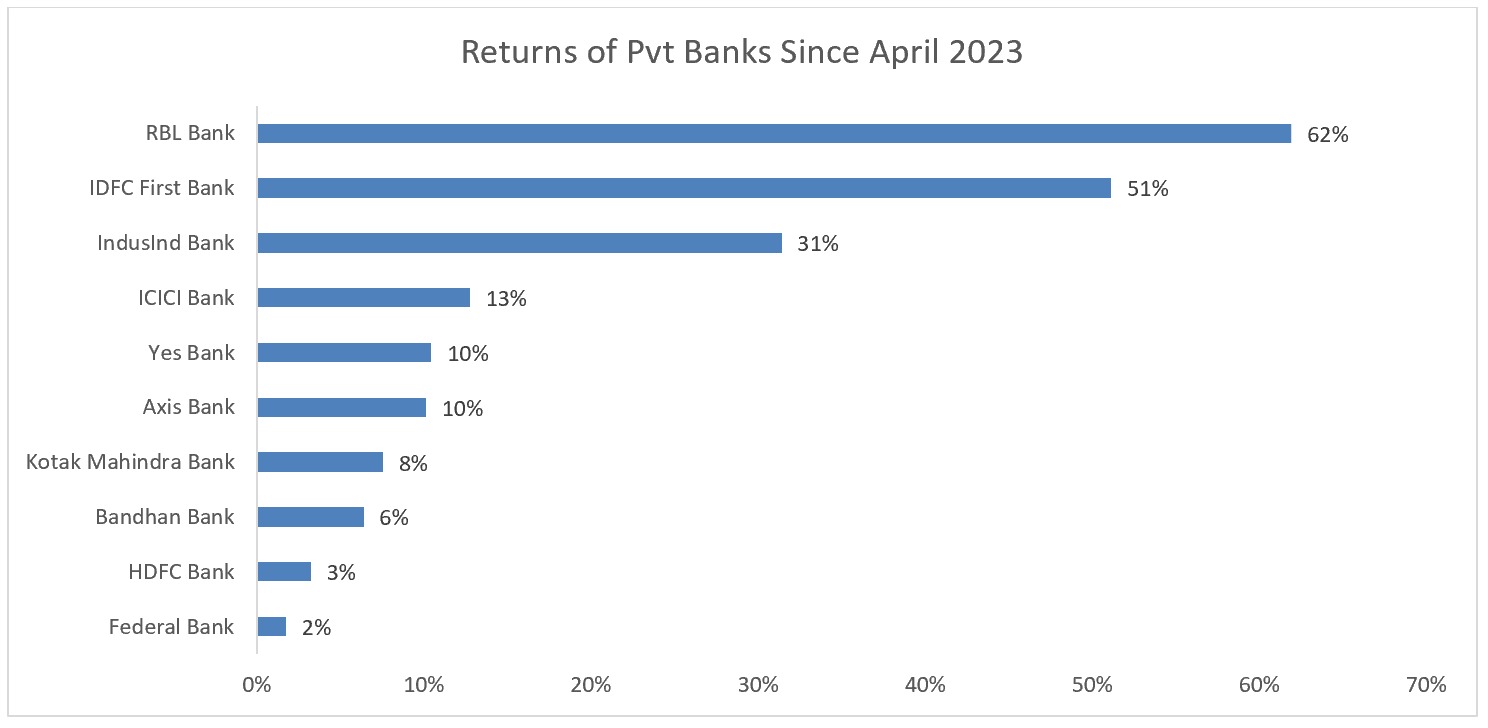

The positive momentum was particularly noticeable among public sector banks, which experienced a significant reduction in bad loans and provisions, leading to substantial profits. Many public sector banks achieved returns in the 20s, with some even crossing the 30 percent mark.

While private sector banks also performed well, they couldn’t match the remarkable performance of their public sector counterparts.

Improving Financial Performance

The remarkable outperformance of banks can be attributed to their significant improvement in asset quality over the past five years. This positive trend is evident in the net non-performing asset figures reported by banks. For instance, India’s largest lender witnessed a substantial decrease in net NPAs from almost Rs 66,000 crore in FY19 to over Rs 21,000 crore in FY23. Similarly, IOB Bank’s net NPAs reduced from Rs 14,400 crore in FY19 to Rs 3,300 crore in FY23. In FY19, many banks, especially state-owned ones, incurred losses due to higher provisions and bad loans. However, the scenario turned around, and all banks reported profits in FY23, with some achieving their highest ever profits.

Punjab National Bank, the country’s second-largest public sector lender, witnessed a significant turnaround, reporting a profit of Rs 2,500 crore in FY23, compared to the massive loss of over Rs 9,900 crore in FY19. Notably, this strong credit growth occurred despite a steep interest rate hike by the central bank to tackle inflation.

The preference for public sector banks on Dalal Street also witnessed a notable shift. While they were once considered less favourable due to low return on equity and stressed books, they have now become the top choice among investors over the last couple of years.

In FY23, earnings for Nifty Bank constituents remained strong with 38 per cent YoY growth. The strong earnings momentum in Indian banks was driven by healthy loan growth, stable margins, and asset quality improvements with a sharp revival in PSBs profits in the second half of the last year that continued in FY23 as well.

In FY24, money managers are favouring domestic-oriented sectors, particularly financials, due to the headwinds facing developed economies. India’s growing economy, strong credit growth, and the current interest rate environment make financials an attractive investment. They offer exposure to multiple sectors of the economy, including capex, industrials, retail, and corporate, making them a compelling opportunity for investors.

Growth Continues

The Reserve Bank of India (RBI) has kept the repo rate unchanged at 6.5 per cent for the second consecutive time. The RBI is confident that inflation will moderate and economic growth will be positive in the fiscal year 2024 (FY24). The RBI projects that CPI inflation will be 5.1 per cent for FY24E, with Q1 at 4.6 per cent, Q2 at 5.2 per cent, Q3 at 5.4 per cent, and Q4 at 5.2 per cent. GDP growth is forecast at 6.5 per cent for FY24E, with Q1 at 8.0 per cent, Q2 at 6.5 per cent, Q3 at 6.0 per cent, and Q4 at 5.7 per cent. Lower inflation number and interest rate bodes well for the credit growth of the banks. The RBI will continue to manage liquidity in a way that ensures that there are adequate resources available for the productive sectors of the economy. Credit growth is expected to remain healthy, led by the SME and retail segments. Deposit mobilization is also expected to improve.

The provisional growth numbers reported by a few banks reflect a healthy credit growth trajectory for Q1FY24E. According to the RBI data, as of June 2023, the industry has seen a credit growth of 15.4 per cent YoY/ 2.5 per cent QoQ, despite seasonal weakness in Q1. This was driven by the retail and SME segments. Personal loans expanded by 19.2 per cent YoY for Quarter Till Date (QTD) vs 16.3 per cent a year ago, mainly driven by housing and vehicle loans. Credit to industry registered a growth of 6.0 per cent YoY QTD. Size-wise, credit growth to large industries saw further moderation at 3.9 per cent YoY. (2.1 per cent a year ago). Nevertheless, we expect the corporate segment to pick up gradually in FY24E, led by increased working capital requirements and push for huge capex. The credit growth to the services sector accelerated to 21.4 per cent YoY, primarily due to the improved credit offtake to Non-Banking Financial Companies (NBFCs). We expect the credit book to grow at an average of 17.7 per cent YoY/ 2.7 per cent QoQ as of June 30, 2023.

Attractive Valuation

Looking back over the past five years, both indices (Nifty 50 and Bank Nifty) have demonstrated robust performance, however, Bank Nifty exhibited 63 per cent growth, while Nifty 50 outperformed with an impressive 74 per cent return over the same period. Therefore, much of the catch up need to be done by Bank Nifty.

Despite all the recent outperformance by banks, they are trading at reasonable valuation. The following picture shows the three broad valuation parameters and their last five year average and none of them are in extreme position.

For example Bank Nifty PE is at 17.26 compared to its last five year average of 24.18x, similarly price to book value also looks reasonable at 2.83x. Even the current dividend yield stood at 0.76 per cent better than 0.43 per cent, which is last five year average.

Given the improving operational and financial metrics and return ratios along with reasonable valuation, provide a better re-rating opportunity amongst banking stocks and they will continue to provide better returns for investor in FY24 too.

In the following pages we are giving five best banks on which you can ride the banking rally in FY24 and beyond.

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.