Moving on the wheels of Confidence

By IE&M Research

Since Indian rice producers are focusing more on the Basmati rice market due to higher margins and larger market overseas, most of the large players are now getting more than 70% of their revenue from Basmati rice. Let us look at the Basmati rice market – India is estimated to export 4.09 MT of Basmati rice in 2017-18 valued at around Rs2000 to 22500 crore. The Basmati rice industry experienced moderation due to declining International demand, after peaking at Rs29300 crore in 2014-15; however the demand witnessed some stabilization in 2016-17. Basmati rice exports have grown at CAGR of 16.2% over FY07-16 from 1mn MT to 4 mn MT. The average realization has come down from Rs77988/MT in FY2014 to Rs56149/MT. By volume Basmati rice constitutes only around 6% of the total rice production. But in value, it constitutes almost 60% of the total export from India. Saudi Arabia, United States, Iran, United Arab Emirates, Iraq and Kuwait are the major export destinations for Basmati rice.

Company

LT Foods Limited is a leading integrated

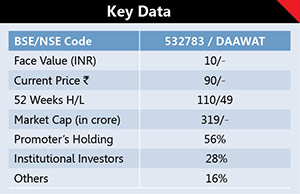

Basmati rice producer, enjoying top two market position in 7 countries including India and US. Incorporated in 1990, the company is primarily engaged in the business of milling, processing and marketing of Basmati rice. The company enjoys an established brand presence, both in the domestic and international markets with well known brands including Daawat, Heritage and Royal. Their product portfolio also includes brown rice, white rice, steamed rice, parboiled rice and organic rice. Recently, the company has further augmented their product portfolio with successful launch of value-added staples such as Maida, Suzi, Daliya, Poha, Besan and Atta under brand ‘Devaaya’. Its manufacturing facilities are located in Haryana, Punjab and Madhya Pradesh with a combined milling capacity of 82 tons per hour (TPH). LT Food is aggressively moving towards becoming a Global Specialty Food company with the launches of non-rice products along with the value added products in rice varieties.

The company’s integrated operations span the entire rice value chain – right from farm to fork. The company has 5 state-of-the-art manufacturing units in India, 2 packaging facilities in the US and in addition deploys 5 more third-party facilities to manufacture high quality food products. LT Foods operations include contract farming, procurement, storage, processing, packaging and distribution. It is also engaged in research and development to add value to rice and rice food products. LT Foods, with strong brand and broad distribution platform, has been able to gain share in branded business in India, Europe, USA and Middle East. Its organic business has been growing fast in USA and Europe. Further, JV with Kameda for rice-based snacks Kari Kari and likely Basmati rice export to Iran that is to begin from December 2017 provides for huge opportunities to scale up the business.

The New Development

- LT Food is becoming a diversified player getting in pulses, organic food, value added products

- Focusing on Daawat and other brands like Royal, Ecolife and Devaaya

- Having Amitabh Bachchan and Chef Sanjeev Kapoor as brand ambassador gives better visibility in local as well as Indian dominated US and European market

- Leveraging different markets with launches for different price ranges

- Aggressive in the European market with its own rice processing mill in Rotterdam

- Getting into Middle East market with acquisition of the Golden Seal Indus Valley and Pozana brand

- JV with the Future group to promote local brands like Sona Masori and regional south India rice brands

- Pursuing the Chinese market where import has been allowed for top three players

Financials

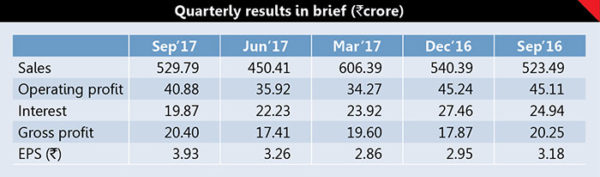

With company expected to clock Rs3600 crore revenue in FY18, it is trying to up the profile of its return ratios. The current EBITDA margin is expected to go up to 20% in the next 3 years with better realization in Basmati products as well as value added products contributing about 30% to 35% to its revenue. This will result in better PAT and return profiles. It has aimed to become a USD 1 billion company by 2022 and already working towards it with all the above initiatives. We expect that it will be able to achieve revenue of Rs5000 crore in next three years and with an EBITDA margin of 20%, it will end up with approximately Rs1000 crore, which given a better than commodity business, can give a valuation of about five times which is Rs5000 crore market cap in next two years.

(Disclaimer: The views expressed herein are based on publicly available information and other sources believed to be reliable. The information contained in this document does not have regard to specific investment objectives. Neither IE&M nor any person connected with the organisation, accepts any liability arising from the use of this document.)