The Multi-bagger in Making

By IE&M Research

Various initiatives of the government to enhance rapid industrialization and infrastructure development, have led to increased real estate development, construction and commercial activities. Due to these drivers, the demand of steel tubes market is expected to grow rapidly. In India, the process industries and the infrastructure and construction industries are primary consumers of steel tubes. The galvanized steel tubes market will grow in proportion of construction. The thrust to serve the demand will be on the back of organic and inorganic growth in the capacity, improved product quality and use of modern technology by industry players.

Apart from the traditional end use in real estate

segment, steel tubes are now widely used in various niche areas, some of them are: Industrial Sheds, Steel Furniture, Bridges, Low cost Steel Housing, Airports, Tripper/Trailer body, Bus Body Structures, Cranes, Towers, Material Storage Racks, Road Dividers, Railway Wagon & Coaches, Hoardings, Machine Components, Pre-fabricated House, Automobile Chassis, Telecom Towers, Scaffoldings, Mine roof support system, Bridge Railing, Poles / Post, Electrical Conduits, Cooling Towers, Electrical / Telecom, and Cable Ducting.

About the Company

Hi-Tech Pipes Limited has become one of the leading manufacturers of Black Steel Tubes, Cold Rolled Strips and Metal Beam Crash Guards. The company is having installed capacity of 3,60,000 mtpa, four manufacturing plants with latest technology located at Uttar Pradesh, Gujarat and Andhra Pradesh, with a distribution network of 300 dealers. It has a rich product portfolio of 450+ SKU’s.

The Company has a diversified product range that caters to various sectors and industries including all PSUs. With a glorious history of 33 years and led by Ajay Kumar Bansal, Chairman & Managing Director, the Company is a market leader in Crash Barrier segment and is foraying into Solar Structures segment. Company is now foraying into new high quality products and high margin businesses like manufacturing of high quality Precision Tubes at Sanand and Hindupur facilities, Solar mounting structures segment at Bangalore and has started commercial production of Galvanized Steel Tubes at Hindupur facility.

The Company is one of the largest buyers of Hot Rolled Coils from SAIL and has provided employment to more than 750 people. With a constant drive to move up the value chain, the company’s emphasis is always on increasing the value added products and offering a wide range of products across segments. Over a period of time, the company has developed many new applications of its products viz. Green House, Defence Shelters, Telecom Towers, Solar Mounted Structures etc.

In line with its commitment to environment and making themselves energy self sufficient, the company has installed 4,00,000 kWh/year capacity Rooftop Solar Power Project at its Sanand, Gujarat facility.

The Company has crossed a milestone turnover of Rs1000 crore during the financial year 2017-18 with growth of 59% over preceding financial year and working towards reaching installed capacity of one million metric ton per annum.

Strong Project Execution

With its rich green-field & brown-field project execution capabilities, the Company has successfully set up and commissioned its new factory at Sanand and Hindupur in record 10 months. Also, the capacity expansion at the existing facilities was done in a record time. With this expansion in place, the Company will be able to strengthen its base in the Western and Southern market and is set to tap opportunities for value added Galvanised Pipe in Southern market.

PAN India Distribution Network

The Company has more than 300 distributors on pan India basis and enjoys a healthy relationship with leading Architects, Builders & Contractors. The Company is now among preferred brands and is registered with all leading industrial consumers and approved by leading Architects, Builders and Contractors. Reputed names like L&T, NHAI, EIL, BHEL, DMRC, PGCIL, AAI, MMRDA, PWD, MES, RIL etc. prefer the Company’s products due to its quality and competitive price.

Opportunities

Rural India: Rural India is expected to reach per capita consumption of 12.11 kg to 14 kg for finished steel by 2020. Policies like Food for Work Programme (FWP) & Indira Awaas Yojana, Pradhan Mantri Gram Sadak Yojana are driving demand for construction steel in rural India. In FY16, per capita consumption of steel in rural India is estimated at 60 kg, which is lower in comparison with the global average of 216 kg.

Government Initiatives: Various government schemes like Housing for all, Smart Cities projects, 24X7 Electricity, National Highway Development Program, Renewable Energy Target 100,000 MW, PM Krishi Sanchar Yojna, Swachh Bharat Abhiyan, Affordable Housing and E-Rickshaw scheme will provide immense opportunities.

Infrastructure: Investment in infrastructure is expected to be USD650 billion in the next 20 years. This huge investment is set to raise steel demand by roughly 18.75 MTPA. Investments of USD33.06 billion would be made in the steel sector in the coming years -unleashing huge potential for the Company.

Oil and gas: There is lucrative opportunity in the Oil and gas segment as it is amongst major end-user segment accounting for 34.4% of primary energy consumption.

Capital Goods: The capital goods sector accounts for 11% of steel consumption and expected to increase to 14% by 2025-26 and has the potential to increase in tonnage and market share. Corporate India’s capex is expected to grow and generate greater demand for steel.

Power: The government targets capacity addition of around 100 GW under the 13th Five-Year Plan (2017– 22). Both generation & transmission capacities would be enhanced, thereby raising steel demand from the sector.

Consumer Durable: The capital goods & consumer durables sectors are expected to grow at 7.5–8.8% over 2012–21 led by the government’s push and higher spending by low and middle income segment.

Automotive: The automotive industry is forecasted to grow in size by USD74 billion in 2015 to USD260-300 billion by 2026. With capacity addition, demand for steel is expected to be robust.

Airports: In FY17, the number of operational airports stood at 94 and more modern and private airports are expected to be set up which would sustain consumption growth for steel pipes. Estimated steel consumption in airport building is likely to grow more than 20% over next few years. Development of Tier-II city airports would sustain consumption growth.

Railways: The Dedicated Rail Freight Corridor (DRFC) network expansion would be enhanced in future. Gauge conversion, setting up of new lines & electrification would drive steel demand. The railways sector could create business opportunities worth USD 99.65 billion in the coming years for the steel industry.

Performance Overview

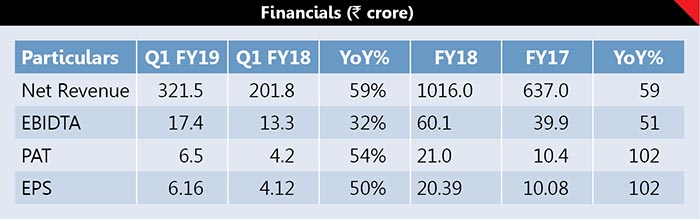

- Net volume is 60,021 mtpa in Q1FY19, as against 48,599 mtpa in Q1FY18, a YoY growth of 24% over corresponding quarter, driven by increase in capacity utilization and adding new capacities

- Revenue from operations is 5 crore in Q1FY19, as against Rs201.8 crore in Q1FY18, a YoY growth of 59%, mainly on account of higher volumes and increased realizations

- Share of high value added products doubled in Q1FY19 over Q1FY18

- EBITDA stood at Rs17.4 crore in Q1FY19 as against Rs13.3 crore in Q1FY18, YoY growth of 32%, mainly on account of better operational efficiencies and expansion in higher profitable markets of West (Sanand, Gujarat) and South (Hindupur, Andhra Pradesh)

- EBITDA per ton in Q1FY19 stood at Rs2,906, as against of Rs2,726 in Q118, a YOY increase of Rs180

- Profit after Tax is Rs6.5 crore in Q1FY19 as against Rs4.2 crore in Q1 FY18, YoY growth of 54%

- EPS is 6.16 in Q1FY19 as against of 4.12 in Q1FY18, YoY growth of 50%

- Market leader in Metal Beam Crash Barrier Market

- Increased focus on Brand visibility through various initiatives.

(Disclaimer: The views expressed herein are based on publicly available information and other sources believed to be reliable. The information contained in this document does not have regard to specific investment objectives. Neither IE&M nor any person connected with the organisation, accepts any liability arising from the use of this document.)