Certainly a potential multibagger

In our May 2018 issue, we had covered this stock when it was trading at around Rs90. In a very highly negative sentiment scenario for small-cap and midcap stocks, this stock zoomed to Rs226 level in just 9 months and recorded almost 150 percent appreciation for our valued readers. Recently it has come down due to profit booking and we feel it is great opportunity to enter again in this stock. We strongly believe that IOLCP is an opportunity in a decade and it certainly is a potential multibagger. It is all based on certain solid facts, which are listed below.

By Pratit Nayan Patel

Established in 1986, IOLCP is India’s one of the leading generic pharmaceutical company, and is significant player in the organic chemicals space. It operates through Chemicals and Pharmaceuticals segments.

Chemicals Segment

IOLCP is a major manufacturer in the specialty organic chemical space. It is one of the largest producers of Ethyl Acetate (87,000 TPA) and ISO Butyl Benzene (IBB) in India with over 30% of the global market share and a major player in Ibuprofen. It has forward-integrated this vertical to the pharmaceutical segment with end products such as Ethyl Acetate, IBB, MCA and Acetyl Chloride used as key raw materials for Ibuprofen. It plans to explore its presence in other industries such as paints, flexible packaging and glass. In line with this approach, it has added many MNC giants to its customer base.

Some names of its chemical segment clients: Akzo Nobel, Sun Pharma, BASF, UFLEX, Teva, Granules, ITC, Strides Pharma, UPL, DIC etc.

Pharmaceuticals Segment

With a presence in 56 countries, IOLCP has established itself as a major player in Ibuprofen with above 30% of the global capacity. It is the world’s only backward-integrated Ibuprofen producer (10,000 TPA) that manufactures all intermediates and key starting materials at one location. It has augmented its pharma business by moving up the value-chain with entry into lifestyle drugs for pain management, anti-depressant, anti-diabetic, anti-platelet and anti-convulsion. IOLCP’s Ibuprofen plant is USFDA and EUGMP certified by the National Institute of Pharmacy and Nutrition, Hungary. It contributes 85% to the total revenue of its Pharma division.

Active Pharmaceutical Business (API): Ibuprofen (Pain Management); Metformin Hydrochloride (Anti Diabetic); Lamotrigine Fenofibrate (Anti Convulsant); Clopidogrel Bi Sulphate (Anti Platelet); Fenofibrate (Anti cholesterol). Presently, 6 API’s are already commercialized and 10 API’s are in the advance stage of development.

Some names of its pharma segment clients: Sanofi, Alembic, Cipla, Granules, Aklem Lab, Cadila, Indoco Remedies, Abbot etc.

It has a 17 MW power generation plant for captive consumption with adequate backups for trouble-free operations. Its R&D lab is DSIR approved and is fully equipped to validate the existing processes.

Financials

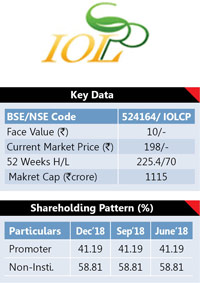

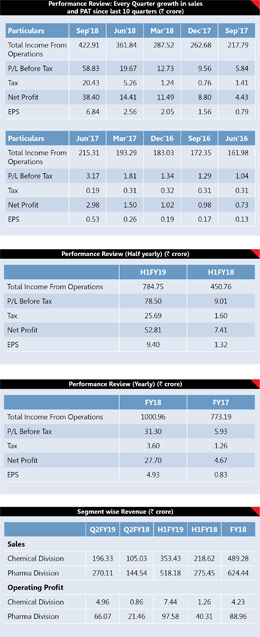

With an equity capital of Rs56.21 crore and reserves of Rs212.34 crore, the promoters hold 41.19% of the equity capital, which leaves 58.81% stake with the investing public. Its share book value stood at Rs48. During FY18, its net profit soared 493.14% to Rs27.7 crore on 29.79% higher sales of Rs1000.96 crore fetching an EPS of Rs4.93.

Recently it has posted robust Q2FY19 numbers. In Q2FY19, PAT zoomed 766.81% to Rs38.40 crore from Rs4.43 crore on 94.18% higher sales of Rs422.91 crore fetching an EPS of Rs6.84 and Cash EPS of Rs9.67. For H1FY19, its PAT soared 612.68% to Rs52.81 crore from Rs7.41 crore on 74% higher sales of Rs784.75 crore fetching an EPS of Rs9.40 and cash EPS of Rs13.82.

Industry Overview

Indian chemical industry is the 3rd largest producer in Asia and 7th by output in the world. By 2025, the Indian chemical industry is projected to reach USD403 billion. The chemical industry in India is a key constituent of Indian economy, accounting for about 2.11% of the GDP. More than 70,000 commercial products such as petrochemicals & basic chemicals are covered under chemical sector. India accounts for approximately 16% of the world production of dyestuff and dye intermediates, particularly for reactive acid and direct dyes. India is currently the world’s third largest consumer of polymers and third largest producer of agrochemicals. India specialty chemical market is expected to reach USD70 billion by 2020.

Indian pharmaceutical sector is estimated to account for 3.1 – 3.6% of the global pharmaceutical industry in value terms and 10% in volume terms. It is expected to grow to US$100 billion by 2025. The market is expected to grow to US$55 billion by 2020, thereby emerging as the sixth largest pharmaceutical market globally by absolute size. The sector is expected to generate 58,000 additional job opportunities by the year 2025. India’s pharmaceutical exports stood at US$16.8 billion in 2016-17 and it is expected to grow by 30% over the next three years to reach US$20 billion by 2020.

Rising Prices of Ibuprofen & Huge GAP in Demand and Supply

Ibuprofen prices have increased by 25-30% due to plant closure by BASF which is a major manufacturer of Ibuprofen. With no capacity addition happening globally, price has tightened due to supply demand mismatch. At the end of FY18, the demand for Ibuprofen was for nearly 40,000 TPA and the global capacity was at roughly 35,000 TPA & IOLCP is supplying 10,000 TPA.

Plant Closure by BASF

The plant is located at Bishop, Texas and has a capacity of around 5000 TPA (which is half from IOLCP). At the start of first quarter BASF plant shutdown due to technical reason, took away almost 1/6th of global production capacity off grid. This has resulted in ibuprofen prices going up by almost 25% – 30%. BASF plant hasn’t re-opened as yet and even if it had, it may not dampen the Ibuprofen price as demand is far higher than supply globally. (BASF was mostly selling in USA while IOLCP is not selling in USA so if BASF will re-open its plant, there is no chance for price competition). BASF has planned a mega plant for Ibuprofen which is going to come live in 2022 (Means demand of Ibuprofen is increasing very fast and if new capacity will come in 2022 from BASF it will not effect on prices.)

Recent Announcement

With the mind-blowing numbers in Q2, the Company has announced

• Enhancement of existing manufacturing facilities of Metformin (Unit IV) from 3,000 TPA to 4,000 TPA in Pharma segment. The additional manufacturing facility of Metformin has been installed with capex of Rs2.71 crore. The project cost has been funded through internal accruals.

• Completion of Unit V to manufacture Clopidogrel Bisulphate and Fenofibrate with capacity of 180 TPA with capex of Rs19.26 crore. The project cost has been funded through internal accruals.

Our Take

IOLCP is expanding its API product portfolio and improving cost competitiveness through efficient manufacturing processes and systems and growing relationships with major Indian and foreign generic companies for the sale of APIs. Its APIs are exported worldwide and key markets include Europe, Latin America, Africa and the Middle East. Ethyl Acetate has varied uses in different industries like pharmaceuticals, flexible packaging and printing ink manufacturing, paints and adhesives, etc. Its key markets in chemicals are African countries, Middle East, SAARC countries and Russia. All its products are in demand. We believe that IOLCP is an opportunity in a decade and it certainly is a potential multibagger.

Currently, the stock is trading at just 13.5x. Looking at the trend we are quite bullish on IOLCP. Investors can accumulate this share with a stop loss of Rs125 for an upper target of Rs370-450 in next 18 to 24 months.

(Disclaimer: The views expressed herein are based on publicly available information and other sources believed to be reliable. The information contained in this document does not have regard to specific investment objectives. Neither IE&M nor any person connected with the organisation, accepts any liability arising from the use of this document.)