By Gaurav Khanna

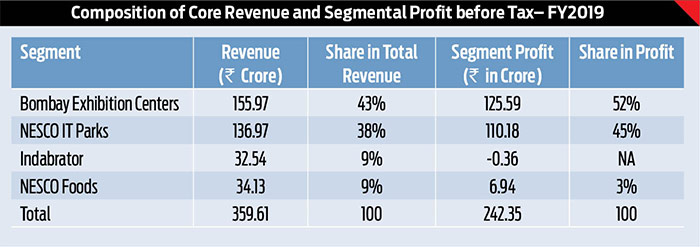

Nesco Limited is a diversified Company in four business segments viz., IT Parks, Exhibition Centre, Foods and Indabrator. While the Indian promoters hold 68% stake in the company, institutional investors including corporate bodies hold around 10%. Nesco’s Bombay Exhibition Centre (BEC) and IT Parks together account for more than 97% of total segment profits – since major expansions are taking place in these two segments, growth opportunities for the future remain substantial. The Company’s net profit margin was 46% in FY2019. This is possible because Exhibition Centres generate an operating margin of close to 80%. Even its newly started NESCO Food started contributing quite significantly to the profits in the initial phase itself. Indabrator, the legacy business of NESCO, is a manufacturer and exporter of surface preparation equipment, providing services to various Indian industries. However, we do not foresee any major contribution from this division to the profits in the near future.

IT Parks: Capacity to Expand

At present, NESCO has two buildings (IT Park 2 and 3 with aggregate leasable area of 0.78 msft) leased out to marquee tenants such as Intelenet, Blackrock, HSBC, MSCI, KPMG, PWC, etc. The erstwhile IT Park 1 will make way for a Hotel cum Convention Center. With the addition of IT Park 4, NESCO’s IT Park capacity has increased to 1.87 mn sq ft from 0.8 mn sq feet in FY2019. IT Park 4 can generate revenue to the tune of Rs200 crore when fully occupied. The Company is expected to use internal accruals to complete IT Park 2 (NEW) over the next 3 years.

Bombay Exhibition & Convention Centre (BEC)

Set up in 1991, Bombay Exhibition & Convention Center (BEC) is presently the largest permanent exhibition Center in the private sector in India. It has been hosting several prestigious international trade fairs/ exhibitions. BEC consists of 6 halls, occupying an area of 0.63 mn sq ft and is planning new BEC space of around 0.15 mn sqft by FY2021E. 118 exhibitions were held in FY2019 out of which 19 were from organizers holding their shows for the first time at Center. Nesco added one new hall (1.16 lsf) at a cost of Rs25 crore recently. Currently its immediate plan is to construct a New Hall in BEC (2.5 lakh sq feet) in order to expand its offerings by August 2020.

NESCO Events

NESCO has also set up an events management division, ‘Nesco Events’, with an immediate objective of optimally utilizing the underutilized space of BEC, without affecting its exhibitions and conventions business. With a vision to build a scalable and impactful event management business, NESCO started with branded events viz., Paddy Fields (a music festival based on the folk fusion theme) and Rangilo Re (organized during the 9-day Navaratri festival). In future, NESCO plans to organize some events outside the BEC campus, in order to capitalize on their gaining popularity.

NESCO Exhibitions

In FY2020 marquee exhibitions including India Auto Show; Machine Tools, Manufacturing and Technology Expo; Hobby & Lifestyle; Edutech India; etc. Nesco’s own exhibitions and events will increase the hall occupancy.

NESCO Foods

It is a division of NESCO, has commissioned two food courts and started food services within the Goregaon complex. Its target segments are exhibition organizers, exhibitors, visitors and employees working in the IT Park. Given the lack of quality eating options in the vicinity the business potential is expected to be strong for these services. NESCO has set up a large kitchen facility which has the capacity and serves 20,000 meals per day. Various corporate, even from outside NESCO compound, outsource their food requirements from NESCO’s kitchen. This business segment has tremendous potential to scale up and once economies of scale kick in, it can potentially generate very high margins.

Financials, Outlook & Valuation

Rapid urbanization is taking place in Mumbai where the Company holds about 70 acres of land. Mumbai city’s landscape is v-shaped and encircled by water on three sides and it is hard to find sizeable free land within city. If we look at the kind of valuation for the land banks in big cities, we get enormous conviction in NESCO. For instance, recently media sources have reported Lodha Developers selling 8 lakh sq. ft. corporate park in East Andheri, Mumbai at a price of around Rs168 crore per lakh sq ft. NESCO has already developed corporate park of around 18 lakh sq ft and proposed to develop another 24 lakh sq ft of new corporate park building. In addition, it has over 6 lakh sq ft of Exhibition Centers. In our estimate, NESCO may end up with surplus of over 30 acres of land even after the expansion of new IT Park.

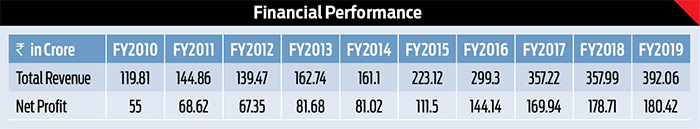

As more and more land parcel is put into commercial use, over the next 10 years, NESCO’s business can potentially generate substantial free cash flows (its current net cash stands at Rs537 crore). In the last 10 years, its net profit has jumped over 3.3 times and we estimate for the next 10 years, its net profit can jump at least by 3 to 5 times.

We are optimistic on Nesco in the short term as well as long term and believe it’s a good value stock considering huge land bank, significant free cash on the books and continued expansions of IT Parks and Exhibition Centre.

Reasons for bullish view

1. Its rental business model is a play on inflation – as inflation rate remains steady in the positive zone, the rentals keep rising in India. NESCO is engaged in the right business model and right location to capitalize on the growing opportunity. It has got locational advantage as the new metro station is coming right in front of its property. We feel, NESCO could attract huge demand for its corporate park in the medium to long-terms due to superior connectivity.

2. NESCO, despite huge cash on the books, rich land bank and promising outlook in terms of earning growth due to expansions, trades at 20.6x its FY2020E EPS of Rs27 and at 16.5x its FY2021E EPS of Rs33.7. Bombay Exhibition Centre and Food Division are expected to register a growth of 15-18% and 40% respectively as per management guidance in FY2020. NESCO holds cash and cash-equivalent of Rs537 crore (as of FY2019) and it remains as the debt-free company.

Final Take

Thus, we maintain our view that this stock could emerge as a multibagger in the next 3 to 10 years. Our valuation is driven by the restructuring of NESCO IT Park, increase in rentable space of Bombay Exhibition and the expected increase in rental rates. The optimism is also supported by a healthy balance sheet, consistently positive free cash flow generation which enables in funding capex by internal accruals along with management’s visionary growth-oriented focus, presence in niche profitable business model with expansion of the flagship business over the next 10 years give enormous confidence in the outlook for this stock. We maintain one-year price target of Rs700, which is 20.7x its FY2021E EPS of Rs33.7.

(Gaurav Khanna is VP – Research, Equinomics Research & Advisory)

Disclosure: Equinomics as the Company, its founder and associates, its clients have invested in the shares of NESCO.