In the last few quarters, the Indian equity market has given spectacular returns. Most of the sectors barring the few have generated returns in such a short period of time that they have not generated in decades – one of them being the textile sector. In the last year, the average return generated by them is in double digits. Our analysis of the share price of 200 odd textile companies shows that on average they are up by 148 percent from their recent lows. Shares of companies like Digjam and Adinath textiles are up by a whopping 3456% and 4804% respectively.

Most of the investors will assume that a rising tide lifts all the boat, better performance by the stock market, in general, is helping these companies to show such performance. Nevertheless, some fundamental change has taken place in the last one and a half years that has led to some structural change that will help the sector to chart a different growth trajectory from here on.

Textile Sector in Brief

The Textile & Apparel (T&A) industry size is USD140 billion in India and it contributes around 5 percent of India’s GDP. Exports make up 24% of the Textile sector and 12% of the overall export earnings of the country. The T&A sector is likely to witness a 10% CAGR over FY20-26E to USD255 billion. The factor that will be helping the sector is first and foremost increased domestic demand due to rising per capita consumption of apparel. Second is work from home culture is likely to stay one or other form, which has led to an increased focus on home improvement products. In addition to these robust government policies are acting as stimulants for the sector.

The best part of the growth for the sector will come from exports, which have remained almost stagnant in over a decade, due to structural changes in the demand pattern being witnessed by India. Nevertheless, they are expected to grow faster than the domestic market at 11% CAGR (from USD34bn in FY20 to USD 65bn in FY26E), primarily driven by growth in home textiles and apparel.

Growth Drivers

Higher Growth from World’s Largest Economy

The USA is the biggest and most crucial geography for Indian home textile players as the country is the largest consumer market in the world, besides the largest economy in the world and the large proportion of organized retail in the country. All these make the USA an important market not only for India but for all the textile exporting countries.

India has a strong presence in the home textiles category in the US with around 40 percent share in the USA total imports. The USA is currently witnessing higher retail demand as a result of subdued spending during the Covid-19 pandemic lockdowns and stimulus cheques Americans had received, which have boosted disposable income significantly. Further, reopening of the economy (including retail outlets) and regaining of lost employment by the broader population has enhanced this effect even more.

‘China+1’ Adoption to Spur Demand

Globally manufacturers are moving away from China to diversify and shift manufacturing to other competing nations. This initiative is known as the ‘China + 1’ strategy. Manufacturers are avoiding concentration in any one geography and diversifying production for more long-term stability. Also, the Covid-19 induced supply-chain disruptions coupled with the US-China trade tensions have accelerated the pace at which companies are diversifying their base.

Manufacturers are looking for replacements and India is the most obvious alternative to China due to an abundance of raw materials and resources, cheap labour, improving ‘ease of doing business,’ and large manufacturing infrastructure. In fact, Indian cotton is 30% cheaper than Chinese cotton and Indian labour is 3 times less expensive than China. Thus, global manufacturers do not view China as the cost-effective haven anymore. Further, India is the largest producer of cotton in the world.

China has a 39% share in global home textiles exports, followed by India with 11% share; thus, India is a suitable ‘+1’ as it is the second-largest home textiles exporter.

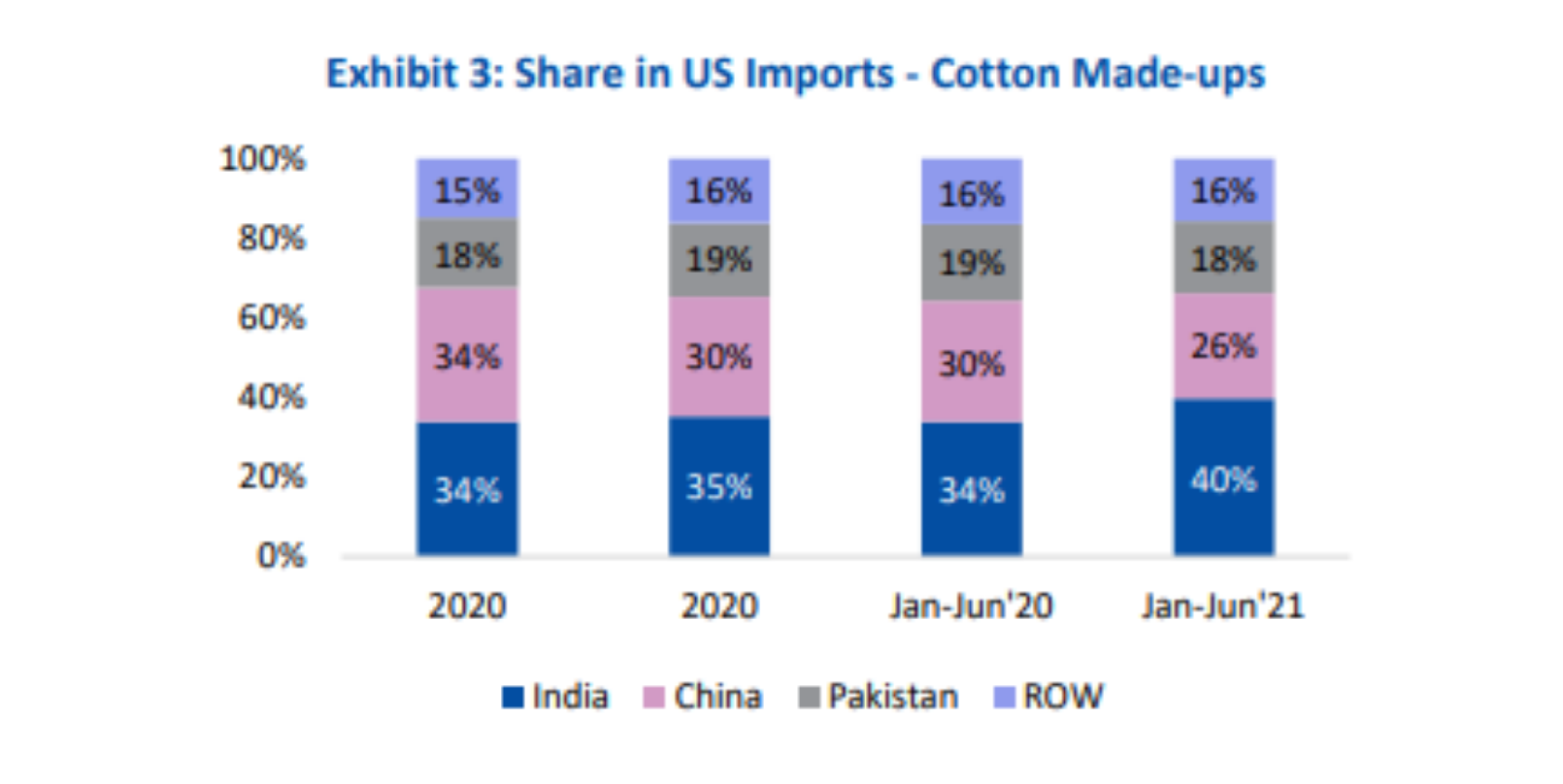

What is also acting in favour of India is the US banning Xinjiang cotton and its products from being imported into the country. Consequently, a bill was passed by the US Senate making the ban official. Following this, China has seen its market share tumble in nearly every cotton category. Market share gains for India are evident in Cotton Made-ups, and within that, especially in Bed Linen where market share has shot up from 51% in Jan-Jun’20 to 62% in Jan-Jun’21. Also, the US’ ban on Xinjiang cotton exports is bound to trigger a material shift in global apparel trade as China is the world’s leading apparel exporter, accounting for more than 35% of the global trade. Also, more than 80% of China’s cotton originates from the Xinjiang region.

image2

Government Supportive Policies

PLI in Man-Made Fibre (MMF) and Technical Textiles was the need of the hour India has remained stagnant in MMF-based apparel in the EU while Vietnam and Bangladesh have gained share from China. It is abundantly clear that India is not globally competitive in MMF-based textile products (Chinese MMF is 20-25% cheaper than India). Mills in India hardly have the bandwidth to churn out volumes that would make Indian MMF as competitive as China.

Understanding the need to make India a global MMF sourcing destination, the government has unveiled a PLI for MMF-based Apparel and Technical Textiles. The main objective of the scheme is to enhance India’s manufacturing capabilities by increasing investment and production in the MMF segment and Technical Textiles. The scheme applies to 40 categories of apparel/made-ups in MMF and 10 categories of Technical Textiles to the extent of Rs 10,683 crore. The investment will be made over a 5-year period with FY20 as the base year. As per CRISIL, the PLI will boost the competitiveness of exports by 4-5% (offsetting a portion of the tariff impact).

In the following section, we have handpicked some of the best companies from this sector that you can weave into your portfolio to build a strong portfolio.

Companies

Gokaldas Exports Limited

- Highest revenue growth of 30% in Q2FY22 on yearly basis

- US contributes roughly 65 per cent of sales

- A rapid expansion of its production capacity

- Capacity is fully booked for Q3FY22 and Q4FY22

- A structural long term story to play the apparel export space

Gokaldas Exports (GEL) is the one-stop-shop for the world’s most acclaimed brands. It is the largest manufacturer and exporter of apparel in India. GEL has an annual capacity of 30 million pieces. Gokaldas focuses on manufacturing complex garmenting products that insulate it from other price-based competition. The Company has an impressive clientele of leading international brands with ‘GAP’ and ‘H&M’ being a major contributor to revenues. The US contributes roughly 65 percent of sales and rests 35% is contributed by Europe and Asia. GEL scripted a successful turnaround of its business operations under the leadership of the new MD (post exit of Blackstone in FY18).

The company posted the highest revenue growth of 30 percent in Q2FY22 on yearly basis, with export growth of 35 percent. During the quarter, the company set up two units in Karnataka (Tumkur and Bommanahalli), which is expected to be ramped up in the next six months. Besides, it has also initiated work on a new greenfield unit that is expected to be commissioned in early FY23E. With a strong order book, GEL ensured a rapid expansion of its production capacity. The company has seen its employee expenses increase significantly by 40% in Q2FY22 as it has brought back 24000 employees and recruited additional 4000 employees across factories in Q2FY22 to fulfill its order. The management indicated it has a strong order book and its capacity is fully booked for Q3FY22 and Q4FY22. The company is operating the manufacturing units in additional shifts to meet the timely execution of the current order book. GEL presents a structural long-term story to play the apparel export space.

Indo Count Industries Ltd.

- Improvement in financials in the second quarter of FY22

- Realization was up by a staggering 27% YoY

- US retail sales growth witnessed a growth of 14.5%

- Realization has improved by around 25%

- Well placed to surpass its FY22 revenue guidance

Indo Count Industries (ICIL) is one of India’s leading home textiles manufacturers. The company has focused in some of the world’s finest fashion, institutional, and utility bedding and has built a significant presence across the globe. ICIL has maintained its improvement in financials in the second quarter of FY22 despite the lower volume. ICIL reported volumes of 18.9mn meters during the quarter (a decline of 17% YoY). Owing to supply chain issues, the company lost out on booking 2mn meters volume during the quarter. Nevertheless, the realization was up by a staggering 27% YoY and stood at Rs 388/meter (usual run-rate Rs 315-320/meter). Going forward, with strong pent-up demand and the upcoming holiday season in the US the company is well placed to achieve its volume guidance of 85-90mn meters in FY22E. US retail sales growth has witnessed a significant growth of 14.5% in Jan-Sep’21 (3 times higher than usual growth of 3-4%), which indicates good times for the home textile players going ahead too.

Textile players are facing dual challenges of higher cotton yarn prices (up by roughly 60% YoY) and container shortage issues resulting in higher freight costs. However, due to strong export demand, most of the players are able to pass on the prices. ICIL’s realization too has improved by around 25% on account of the price hike taken in Q1FY22 and a better product mix (on account of a higher share of high-value products). With the indication of further price hikes in the coming quarters, ICIL’s operating margins is likely to improve by 270bps to 17.7% in FY22. With the current run rate, ICIL is well placed to surpass its FY22 revenue guidance and a further increase in its share price.

KPR Mill Limited

- Largest knitted garment manufacturer

- Consistent revenue growth & positive operating margin trajectory

- Maintained margins of 18 % with average RoCE of 20%

- New sugar and ethanol plant to be commissioned in Q3FY22

- Opportunities in US market give strong visibility

KPR Mill is one of the largest vertically integrated Apparel manufacturing companies in India producing Yarn, Knitted Grey & Dyed. The integrated manufacturing operations enable the Company to better customize the products as per client specifications and provide consistent quality assurance in a cost-effective manner. This has helped company to exhibit consistent revenue growth and a positive operating margin trajectory with strong return ratios.

It is one of India’s largest knitted garment manufacturers with total capacity of 157 million pieces The company, over the years has maintained margins of 18 % with average RoCE of 20% and D/E ratio of 0.3x.

Revenue for the quarter grew 27% YoY (30% QoQ) to Rs 1211.3 crore. Robust yarn realisations have aided the topline growth. While volume for yarn and fabric division grew 1.4% YoY to 21500 tonnes, realisations inched 33% YoY to Rs 273/kg. Subsequently, revenue from yarn and fabric division grew 35% YoY to Rs 587 crore. Going ahead, the new sugar and ethanol plant is expected to be commissioned in Q3FY22 and the company is targeting a revenue mix of 50:50 from ethanol and sugar division. With the new expanded capacity, the management is aiming at overall sugar revenues to cross Rs 1000 crore in the next two to three years from current Rs 496 crore in FY21. KPR is a structural long term story to play on the apparel export space. Given expansion plan and robust opportunities in US market give strong visibility for sustained growth in company’s performance.

Rupa & Company Ltd.

- The company’s consolidated net profit jumped 16.7%

- Plans to have 300 large-format stores in the next 2 years

Rupa & Company is a knitwear innerwear product company. The Company is present across the entire value chain in the knitted garment space offering a gamut of products from innerwear to fashion wear. It is engaged in the manufacturing, marketing, selling, and distribution of men’s and women’s innerwear, thermal wear. The Company owns a bouquet of knitted innerwear and intimate wear brands in India with flagship brands, such as rupa, Footline, Jon, Air, Macroman, Macroman M Series, Euro, Bumchums, and Thermocot. The company operates, with 125,000+ Retail Outlets, 1200+ dealers, 7000+ SKUs, 18 sub-brands in its vested kitty fetching 700,000+ finished goods pieces per day with a presence across major e-commerce platforms like Amazon, Flipkart, Snapdeal, Myntra etc. Rupa & Co. operates with an asset-light business model with a strong focus on constantly creating and nurturing its brands. The Company is utilizing its incumbent resources to focus more on value addition, product differentiation, branding, and distribution.

Rupa & Co. plans to have a presence across 300 large-format stores in the next 2 years. It also plans to roll out 150 more Exclusive Brand Outlets mainly through the Franchisee-Owned Franchisee Operated route in the next 2 years. It is looking at enhancing brand visibility through increasing E-commerce activities. It aims to increase share in premium and super-premium categories and grow through in-licensing or inorganic brand associations as well through organic growth of the Casual wear range. It has four manufacturing facilities in India at Tirupur, Calcutta, Ghaziabad and Bengaluru, with a capacity of producing 0.7mn pieces/day.

The company’s consolidated net profit jumped 16.7% to Rs 52.97 crore on a 20.7% rise in net sales to Rs 365.47 crore in Q2 September 2021 over Q2 September 2020.

Welspun India Limited

- Major beneficiary of unlocking across the economies

- Target an ambitious top line of Rs12,500 crore by FY25

Welspun India Limited (WIL), part of Welspun Group, is one of the world’s largest home textile manufacturers. It has a global presence in over 50 countries and is a leader in the bed bath & flooring business. WIL is a supplier to 17 of Top 30 global retailers (number one player in US) which makes it the largest exporter of home textile products from India. The home textile manufacturing plants of WIL is located at Vapi & Anjar both located in the state of Gujarat & the Flooring plant in Hyderabad.

In September 2019, WIL commenced its new flooring plant in Hyderabad, spread across 600 acres of land. WIL’s total flooring capacity is at 12.9 mn Sqmt as on Q1FY22 and is further planned to be expanded to 27Mn Sqmt by FY22. This will be a further growth driver for the company.

The Capex spend on expansion of the flooring, advanced textile and home textile businesses are in different stages of completion and is expected to be around Rs.600 crs in FY22, of which Rs.172.2 crore has been spent in Q1FY22.

On the basis of the current expansion and buoyant consumer demand, WIL targets to achieve an ambitious top line of Rs.12,500 crs by FY25 with a CAGR of over 14% during the period. For the current fiscal it targets above 15% growth in revenue on back of home textile growth over 10%, flooring over 125%, and advanced textiles over 50%. Despite all the expansion plans the Company is well poised to strengthen its balance sheet. Net debt stood at Rs.2249.50 crs Vs Rs.2332.7 crs in FY21, Net debt to equity has come down to 0.58x as on June FY22 from 1.0x in FY20. WIL is well placed to be the major beneficiary of unlocking across the economies.