It does not take much in the stock market to change. The fortune of investors, companies as well as sectors transform without much of delay. Heroes of yesteryear may become zeros in no time.

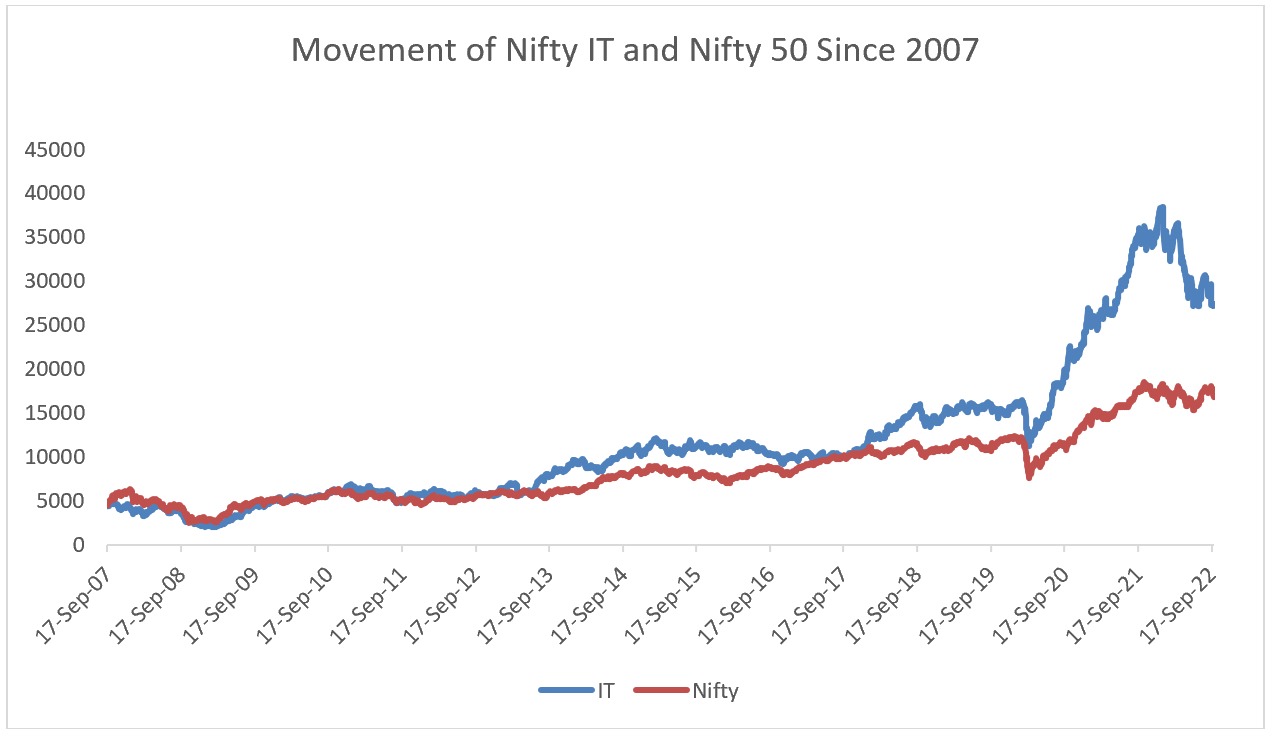

Information Technology sector is one of those unfortunate sectors that saw its fortune changing diametrically opposite in last few quarters. After two years of outperformance in 2020 and 2021, the Nifty IT index in YTD CY22 has underperformed the Nifty by a huge 24 percentage points. Nifty 50 in last nine months is down by five per cent while Nifty IT index is down by 30 per cent. Despite such fall Nifty IT index is still outperforming the Nifty 50 by huge margin since the start of year 2020. From the start of 2020, Nifty IT index is up by 76 per cent while Nifty 50 is up by 38 per cent.

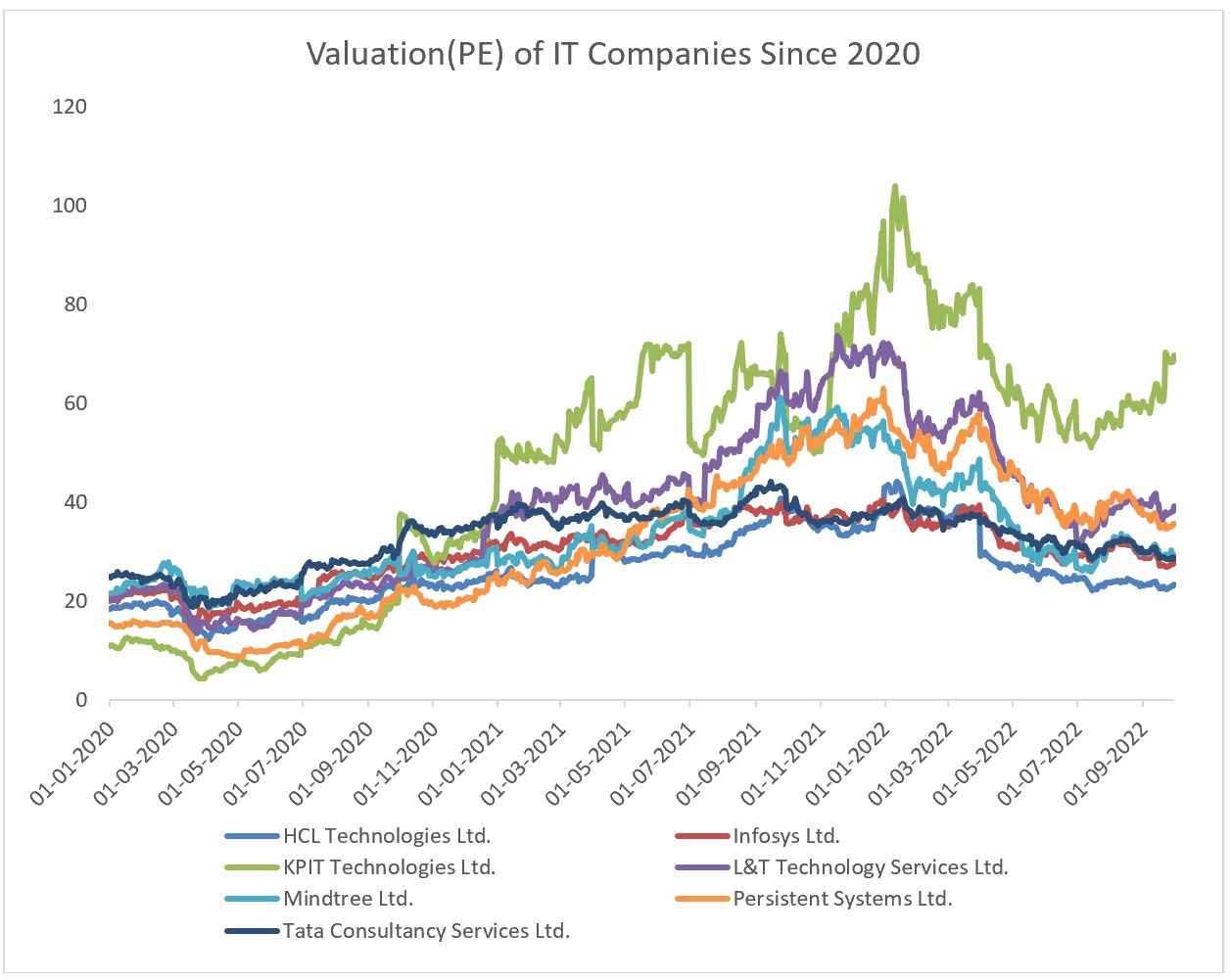

The starting point for the underperformance was the runaway valuation of IT companies especially Tier-2 IT companies. Since the start of year 2020, valuation of the IT companies have moved up substantially. For most of the major companies it has reached to almost four times it was trading at the start of the year 2020. For example, KPIT Cummins, which was trading at PE of almost single digit, is currently trading at PE of 69 times.

Despite all this fall in IT index and prices of IT companies, valuation is still above the start of 2020.

Factors Impacting

One of the factors that led to such fall in the IT company’s share price is higher inflation, which normally leads to higher interest rate. Such higher rates are always a dampener for overvalued stocks. IT companies are normally considered as growth stocks. What also is impacting the IT companies is concern developing around earnings in FY23 and FY24 in the context of potential cut back on IT budgets and spending by top customers. The current aggressive stance taken by US Fed to tame inflation may lead to recession, which will impact the entire economy including IT budgets.

This is reflected in Accenture’s (ACN) latest result. It started FY23 (ending Aug’23) with lower-than-expected guidance for Q1FY23 as well as for the full year factoring-in the impact of a challenging macro-environment. Q1FY23 revenue guidance stood at US$15.2 billion -15.75 billion, +10-14% YoY constant currency (CC), much below Bloomberg consensus estimate of US$16.1 billion. For the full year, ACN expects to deliver 8-11% YoY CC revenue growth, including 2.5% inorganic contribution, and assumes foreign exchange impact to be at a negative 6%. This implies 2-5% YoY USD growth, much below Bloomberg consensus expectations of 8.3%.

Down But Not Out

Looking at the current fall, we believe that price-wise correction is now almost over, in worst situation we can see another 5 per cent fall from current level.

Infosys already made new low, TCS too just Rs 80 up from its bottom. Historically we have seen that this is one of the three largest downfall in IT index. Before this there were only two incidences when IT index has fallen more than the current fall. The worst was the dotcom bust after which the IT index lost 90 per cent and entire peak to recovery took more than ten years.

| Top 10 Drawdown In Nifty IT Index | ||||||

| From | Trough | To | Fall | Length (Days | To Trough (Days) | Recovery (Days) |

| 22-02-2000 | 21-09-2001 | 14-10-2013 | -90% | 3408 | 398 | 3010 |

| 20-02-2020 | 23-03-2020 | 15-07-2020 | -32% | 97 | 21 | 76 |

| 18-01-2022 | 15-07-2022 | NA | -30% | 174 | 123 | NA |

| 17-03-1999 | 28-04-1999 | 19-07-1999 | -27% | 82 | 25 | 57 |

| 04-03-2015 | 21-11-2016 | 17-01-2018 | -24% | 713 | 423 | 290 |

| 03-03-2014 | 19-05-2014 | 24-07-2014 | -16% | 99 | 51 | 48 |

| 03-10-2018 | 22-11-2018 | 26-04-2019 | -16% | 140 | 35 | 105 |

| 08-02-1999 | 08-02-1999 | 01-03-1999 | -15% | 16 | 1 | 15 |

| 02-05-2019 | 22-10-2019 | 13-02-2020 | -12% | 197 | 116 | 81 |

| 02-12-2014 | 15-12-2014 | 03-02-2015 | -11% | 44 | 10 | 34 |

Therefore, we believe that pricewise correction is almost over and in worst case scenario it will fall another five per cent in case some negative surprises that we saw emanating from UK. Many of the large cap companies are already trading at 52-week low and we may see some time wise correction.

What will support price is strong financials of IT companies and expected better demand. Despite all the fall, most of the frontline companies never made a loss and these companies reward their shareholders regularly by paying dividends or buyback. Moreover, US industry is highly based on IT ecosystem and they can’t run without that. Hence, our assessment is the downside will not exceed for next 2-3 quarters.

The Indian IT services industry has gained strong deals across geographies and across verticals. It has gained more than USD170 billion in FY22, showcasing its resilience amidst a tough macro environment. Demand for digital transformation remained resilient as several business conglomerates and industries are investing in newer technologies owing to cost optimizations and revenue-driven systems. New IT architectures and structures, demand for digital transformations, and the emergence of new-age technologies such as cloud transformations, Artificial Intelligence (AI), IoT, Cyber Securities, Business Analytics, and Data Securities are expected to drive the industry’s growth moving forward.

The Road Ahead

While the Indian IT sector emerged stronger post-Covid, the valuation multiples had significantly outpaced earnings growth. This has been corrected to some extent this year, but most of the excessive valuation has been completely purged. After a couple of quarters of margin disappointment and demand concerns elevated due to serious macro-economic issues in the main geographies that IT sector is exposed to – North America and Europe, we may see normalisation returning. The nature of slowdown in the US — a soft landing or deep recession, how Europe navigates its inflation/energy crisis may decide the near-term tech sector fortunes going forward.

As businesses continue to rely on technology, both for driving incremental revenue and optimizing costs, the demand for Indian IT Services would remain buoyant despite an uncertain macro environment. Migration and Digital transformation initiatives will continue to drive significant demand for Indian IT companies. Improved pricing, increased off-shoring, greater fresher addition, lower attrition, and decreased reliance on subcontractor expenses will help companies maintain margins. Macro concerns have already been factored in the recent correction in the IT Services space. We remain positive on account of sustained long-term demand.

Our advice to investors is with more than one year of investment horizon can gradually start biting into IT sector companies like systematic investment plan (SIP), investing every month from Diwali to Holi. While there may be some more pain, it is not possible to perfectly time markets. Hence investing in staggered manner is ideal in the current context given the fact that the long-term prospects for the sector, given India’s dominance in the IT services space remains solid.

In the following pages we are giving seven IT companies that are likely to perform better than other companies. One can chose and invest in any three of them. If you’re reading this on app, then click here to read.

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.