Market Outlook

The Indian equity market closed in green for the second consecutive month in the month May 2023, as investors assessed the impact of various factors. The expected pause in US Fed rate hike, RBI’s monetary policy stance, positive global cues, higher FIIs inflows and not to forget better than expected March quarter numbers led to such enthusiasm among investors. The market ended the month with a positive return with Sensex rising by 2.07 per cent in May, while the Nifty gained 2.13 per cent. What also helped frontline indices is Adani Group stocks, which hugely gained following a near clean chit by market regulator, which helped restore investor confidence and buying in Adani Group of stocks. The Sensex closed at 62,621.08 on May 31, while the Nifty closed at 18,541.00. The top gainers in the Nifty 50 in the month of May were Adani Enterprises, IndusInd Bank, Bajaj Finance and Eicher Motors. More than two third, almost 67 per cent of the Nifty 50 constituents closed in green in the month of May. Stock that remained laggard in the month of May were from commodities and pharmaceutical sector.

For the entire year Nifty ended with an 11% EPS growth on a high base of 34% growth in FY22. Earnings, though remain lopsided with BFSI driving almost entire incremental earnings in FY23. With healthy macros, range-bound oil prices, a robust fiscal balance sheets, and moderating inflation, the backdrop for the market is quite optimistic.

BSE 500 Aggregate Performance

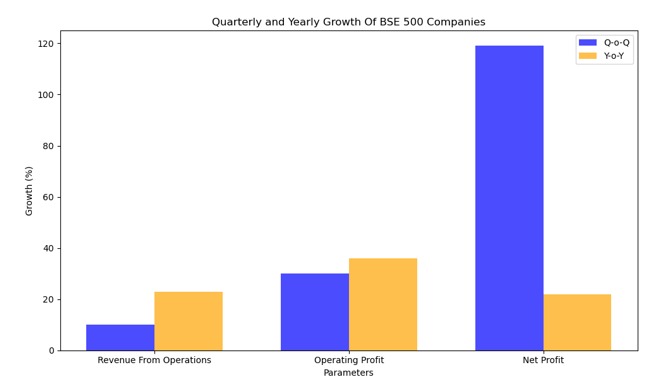

The financial performance of India Inc. in the January-March 2023 quarter has been in line with market expectations, despite the challenging global macroeconomic conditions. The aggregate performance of BSE 500 companies in Q4FY23 was strong, with sales, operating profit, and net profit growing by 23 per cent, 36 per cent, and 22 per cent, respectively. This was driven by a number of factors, including strong economic growth, robust demand, and continued cost-saving due to lower commodity prices.

BSE 500 companies were able to increase their revenue by 23 per cent in the fourth quarter of fiscal year 2023 compared to the same quarter of the previous year. This was primarily due to better number posted by Finance, Hospitality and Aviation sector. When it comes to operating profit BSE 500 companies were able to increase their profits from operations by 36 per cent in the same period. This was a result of factors, such as lower costs, higher sales, and over all a combination of both. Even the net profit growth for BSE 500 companies were at 22 per cent indicates profits after taxes by 22 per cent on yearly basis.

In the following paragraphs we will analyse seven sectors out of BSE 500 companies that cover almost two thirds of its market cap.

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.