In a powerful position

By IE&M Research

Greenply Industries Limited (GIL) is one of the largest interior infrastructure company with a turnover of `1653 crore. It is engaged in the business of manufacturing plywood and allied products and medium density fibreboards (MDF) through its factories at various locations. The Plywood & Allied Products segment is engaged in the business of manufacturing and trading of Plywood, block boards, veneer, doors and other wood panel products, whereas the Medium Density Fibre Boards & Allied Products segment is engaged in the business of manufacturing of Medium Density Fibreboards and other allied products. The company also markets the most comprehensive portfolio of residential and commercial floor products available – plywood & block boards, MDF and Wood floors under the brand names of Greenply Plywood, Green Club Ply, Ecotec, Green Panelmax, and Green Floormax. The company claims to be at top when it comes to plywood and MDF boards with 26% of the organized plywood market in India and 30% market share in the domestic MDF market.

The sectoral benefit

The implementation of GST is addressing  the complexities and inefficiencies of the current indirect tax framework. Plywood dealers were paying excise (12.5%) and VAT (12.5% in most states and 5% in the other states). However, they were not eligible to get any credit for excise duty paid, which in case of GST is cenvatable. Hence, it has resulted in reducing the tax burden eventually in the hands of the end consumer. Within the building material space, GST is likely to benefit the plywood sector the most, with over 75% of the industry being dominated by the unorganised industry. The price differential between the organised and unorganised plywood varied between 15% and 20% in the premium plywood space. This, in turn, would improve the competitiveness of organised players and help it gain further market share. The cost for the unorganised player is also expected to move up due to likely non-avoidance of taxes, which is further likely to bring down the differential between a branded and an unbranded product.

the complexities and inefficiencies of the current indirect tax framework. Plywood dealers were paying excise (12.5%) and VAT (12.5% in most states and 5% in the other states). However, they were not eligible to get any credit for excise duty paid, which in case of GST is cenvatable. Hence, it has resulted in reducing the tax burden eventually in the hands of the end consumer. Within the building material space, GST is likely to benefit the plywood sector the most, with over 75% of the industry being dominated by the unorganised industry. The price differential between the organised and unorganised plywood varied between 15% and 20% in the premium plywood space. This, in turn, would improve the competitiveness of organised players and help it gain further market share. The cost for the unorganised player is also expected to move up due to likely non-avoidance of taxes, which is further likely to bring down the differential between a branded and an unbranded product.

A brief history

Greenply Industries was listed in 1995 after the amalgamation of the erstwhile Greenply Industries Limited pursuant to which the plywood manufacturing unit at Tizit, Nagaland was transferred. Pursuant to the amalgamation, the name was changed to the Greenply Industries Limited. In 2005 after the amalgamation of Worthy Plywood Limited the plywood manufacturing unit at Kriparampur, West Bengal was transferred to the company. In the same year it became the first company to attract FII investment in its sector. In 2007 it acquired Galaxy Decor Private Limited and Platinum Veneers Private Limited as wholly owned subsidiaries which owned the plywood manufacturing facility at Bamanbore, Gujarat. In 2010 the company sets up the largest and most technologically advanced MDF plant at Pantnagar, Uttarakhand.

Manufacturing facilities

The company’s manufacturing facilities are backed by cutting edge technologies and reliable IT infrastructure. The company claims to have a single-window operations, to make its engagements smooth and efficient. The manufacturing facilities include: Tizit, Nagaland where the proximate timber belts of Nagaland help it get an abundant supply of raw material; Pantnagar, Uttarakhand – with its proximity to the region’s vast agro-forestry resources makes it possible to cater to a growing North Indian market. Bamanbore, in Gujarat caters to markets in the Western India; proximity to the Kandla port enables an easy import of raw materials and Kriparampur, West Bengal is very near to the Kolkata port which enables smooth international access.

The Pluses

Shifting of the trend towards the organized plywood sector is expected to propel growth. The Indian plywood industry is estimated at `18,000 crore (largely unorganized), and accounts for a 75% share of revenues. With the implementation of GST, the share of organized players is expected to improve, which would benefit branded players like GIL. Hence, GIL is best placed to gain market share on the back of better product quality, strong brands and wide distribution network.

A robust business model

Over the last three decades, the company has built a robust business model and maintained a strong leadership position across product categories and markets. Going forward, rising disposable income, growing urbanisation and focus on aesthetics and urbane lifestyles will drive the off take of its products.

GIL has been continuously focusing on strong brand visibility. Historically, the company has been spending around 3% of sales on ad spends to increase its brand visibility. Currently, GIL’s products (Plywood and MDF) are available across India. With a strong retail network, 48 branches across India and presence in over 300 cities across 21 states, Greenply Industries provides international quality products to its customers through more than 12,000 distributors, dealers, sub-dealer and retailers.

Capacity addition

GIL has added new MDF plant in Andhra Pradesh, which would increase the capacity from 1,80,000 CBM to 540,000 CBM (new plant can generate revenue of `800-900 crore). Total capex required for this MDF plant is `700 crore out of which the company has already spent `550 crore till 1HFY18 and the balance would be spent by FY2019. The commercial production would start from 2QFY19, boosting the company’s profitability.

Pradhan Mantri Awas Yojana (PMAY)

The government has set an aim to build 1.2 crore houses by 2022 under PMAY, which would increase the demand for plywood industry for making doors and furniture. Moreover, in the lower segment, demand for MDF would increase for these houses.

Strategy for sustainability

The company is promoting large scale clonal plantations of fast growing, short-rotation plywood species on marginal and degraded farm lands (that can be replenished) to meet its raw material requirements for the long-term. Such a strategy will not only reduce its dependence on overseas timber, but also bring down the logistics costs incurred in the procurement of local timber. In addition, the company has commenced the clonal propagation of Melia Dubia, in collaboration with Rain Forest Research Institute. It serves as an excellent raw material for plywood production on account of its higher yield; it takes only six to seven years for it to get ready for harvest.

Financial Outlook

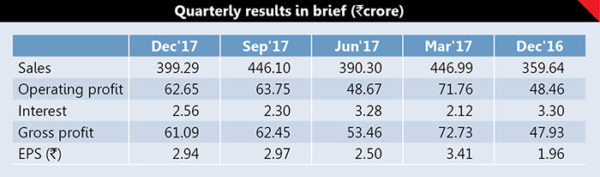

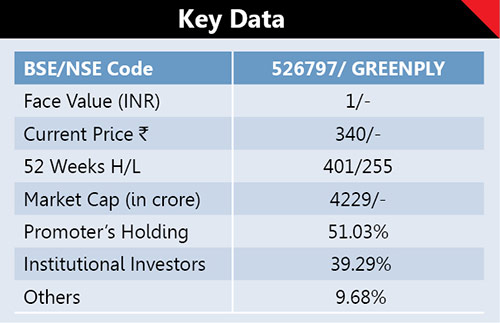

GIL is expected to report a huge jump in its net revenue mainly due to healthy growth in plywood and lamination business and MDF on the back of a strong brand and distribution network. The expansion is also expected to improve the company’s margins in MDF business. At the current market price of the stock trades at PE of 23.3x its FY2020E EPS of `14.6 which is comfortable.

And the Risks

There are some risks also involved. First of all the currency risk as most of the company’s raw material is imported from other countries. The company also has ECB loan, hence any unfavorable change in currency may pose forex risks, which could significantly impact the company’s margins. Secondly, the company is expanding the MDF plant with capex of `700 crore and any slowdown in MDF market can impact the company’s earnings due to higher fixed cost overheads.

(Disclaimer: The views expressed herein are based on publicly available information and other sources believed to be reliable. The information contained in this document does not have regard to specific investment objectives. Neither IE&M nor any person connected with the organisation, accepts any liability arising from the use of this document.)