Gautam Adani’s life is a story of rags to riches. A college dropout who survived two life threatening events went to become world’s third richest man from the unassuming son of a modest textile trading family. In his way to success he did not play a con game as many claim.

The beleaguered Adani Group has lost more than Rs 12 lakh crore or roughly USD 144 billion in market value in last one month after Hindenburg Research report was released on January 24, 2022. To give our readers a perspective of this loss: there were only 56 countries globally at the end of 2022, who had their GDP greater than the loss Adani group of companies suffered in last one month. A country like Kuwait, one of the richest nations with per capital GDP greater than USD 60000, too has national GDP of USD 123 billion.

Impact of Hindenburg Report

| Market Cap (Rs Crore) | Share Price (Rs) | Erosion | |||||

| January 24, 2023 | February 24, 2023 | January 24, 2023 | February 24, 2023 | Market Cap (Rs Crore) | Share Price (Rs) | Contribution to Total Mcap Loss of Group | |

| ACC Ltd. | 43870.86 | 32476.87 | 2336.2 | 1729.45 | 11,393.99 | -26.0% | 1% |

| Adani Enterprises Ltd. | 392473.89 | 149881.65 | 3442.75 | 1314.75 | 2,42,592.24 | -61.8% | 20% |

| Adani Green Energy Ltd. | 303112.53 | 77102.78 | 1913.55 | 486.75 | 2,26,009.75 | -74.6% | 19% |

| Adani Ports and Special Economic Zone Ltd. | 164354.17 | 120740.97 | 760.85 | 558.95 | 43,613.20 | -26.5% | 4% |

| Adani Power Ltd. | 105988.68 | 56619.86 | 274.8 | 146.8 | 49,368.82 | -46.6% | 4% |

| Adani Total Gas Ltd. | 427325.71 | 82881.69 | 3885.45 | 753.6 | 3,44,444.02 | -80.6% | 29% |

| Adani Transmission Ltd. | 307446.52 | 79411.92 | 2756.15 | 711.9 | 2,28,034.60 | -74.2% | 19% |

| Adani Wilmar Ltd. | 74491.08 | 47087.36 | 573.15 | 362.3 | 27,403.72 | -36.8% | 2% |

| Ambuja Cements Ltd. | 98994.34 | 68554.4 | 498.55 | 345.25 | 30,439.94 | -30.7% | 3% |

| Grand Total | 1918057.78 | 714757.5 | 16441.45 | 6409.75 | 12,03,300.28 | -61.0% | |

Hindenburg Research, a US based financial forensic firm and investing group that specializes in targeting and shorting companies, believes that the Adani Group companies have dubious accounting and business practices. The research company alleged that Asia’s richest person is involved in a massive and “brazen stock manipulation” and “accounting fraud scheme.” The report further alleged that the USD 218 billion (when the report came) conglomerate was “pulling the largest con in corporate history.”

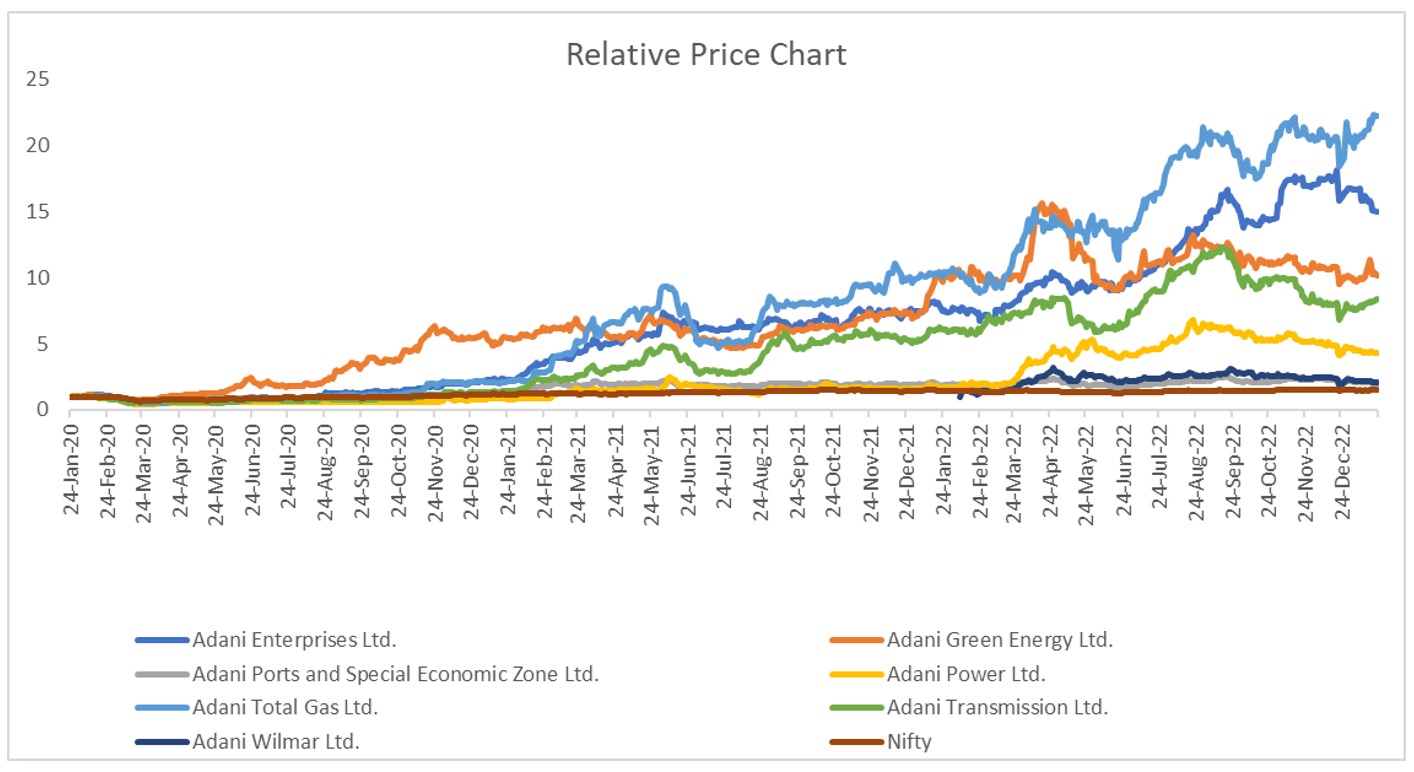

This US based firm has a history of targeting companies globally. Earlier, the financial research firm’s allegations of “intricate fraud” at the US-based electric truck maker Nikola Corporation in 2020 led to its former executive chairman Trevor Milton’s ouster. Hindenburg’s two-year investigation into Adani group has shown that more than USD100 billion was added to Gautam Adani’s net worth in the past three years largely due to an 800% rise in stock prices during this period.

For example, Adani Transmission, one of the group company saw its share price increase from near Rs 200 at the end of March 2020 to Rs 4236 by the end of September 2022 roughly 21 times. Similarly, Adani Total Gas, which was trading at Rs 363 at the start of January 2021 reached the height of Rs 4000 in next one and half year, rising by 10 times. All these added to the wealth of Gautam Adani.

But the Adani Group’s empire faced unprecedented scrutiny after research firm claimed to have “uncovered evidence of brazen accounting fraud, stock manipulation and money laundering at Adani, taking place over the course of decades.” The jury is still out and it will take some time before we come to know how much grain of truth is in the report.

Nonetheless, going by history we have seen that there were earlier incidences where some shrewd investors try to take benefit of the situation just before any company coming out with a public issue. In 1982 too when Reliance Industries’ public issue was about to open for subscription, the bears sensed that the management of the company was artificially keeping the price of the shares high to ensure full subscription to the rights issue. A cartel of bear operators, supposedly from Kolkata, started short selling shares of Reliance Industries. Short selling is a transaction where investors sell shares they do not own, in the hope that the price of the share will fall and they can pick it up at a lower price and make delivery at a later date. Nevertheless, a buying wave began in the shares of Reliance Industries. The more the bears sold the more NRI investors picked up the shares and finally the bear cartel baulked.

In another instance KP Singh of DLF cited how a Canadian firm had threatened to bring out a report when his retail estate firm DLF was bringing out an IPO one-and-a-half-decade back. He further added that there are “blackmailers” who bring out reports around any big share sale.

Even in the current situation we are witnessing history repeating itself with slightly different shade. This Report unfolded just before the largest follow-on public offer (FPO) for Rs 20,000 crore of Adani Enterprises.

Now we will first try to understand the CHARACTER BEHIND THE COMPANY and then we will talk about companies and whether it is investable or not at the current juncture.

Few Factors that Keep Gautam Adani Apart from Most of His Peers and Contemporaries

Happy To Take Risk

We have witnessed in the last couple of years how loss-making new-age companies have raised money from public. These companies have been massive wealth destroyers for the investors especially who invested during Initial Public Offer. It is not only new-age technology companies, even some of the established industrialists would not take project risk in their established business. They would form a subsidiary, raise money from public and finally when subsidiary becomes profitable they would merge with parent company.

Gautam Adani was different in the sense that he took all the risk and went public only after his company starts earning profits. He never forced risks on others. This would also help him to get better valuation and raise more money by diluting less. Therefore, the IPO of Adani Enterprise Limited in 1994 was oversubscribed by 25 times, a sign of the immense trust that shareholders and the market placed on it. Besides, there were instances when a business deal would go wrong, he would try to help the client with other opportunities to cover up his earlier losses. Even in the current situation when the FPO was successfully sailed, he returned the money to investors after the current share price dipped below the subscription price.

Treating Partners Respectably

Anecdotal evidence suggests that Mundra port with its high automation and speed financially compensates any ship that was not admitted and unloaded on schedule. This says a lot about the way company treats its stakeholders including shareholders. This is also exemplified when in some cases, where he wanted to buy out a shareholder, he paid him more than what the market price was. This is what happened when Gautam Adani had to request the state government of Gujarat to give up its stake in the Mundra Port. This attitude has helped Gautam Adani to gain trust and loyalty from others. This also shows another remarkable character of his of maintaining good relation with his acquaintances and business partners. HE HAS NEVER IMPOSED HIMSELF ON HIS PARTNERS TO SQUEEZE THEM TO GET BETTER DEAL. He would like to keep his partners with him all through the journey. When a deal does not work out the way it was expected to, two partners invariably part ways amicably and there is hardly any incidence when any partner has leveled serious allegation against him.

Take for instance the Adani-Wilmar venture story. It is a 50:50 venture, where Wilmar and Adani hold equal stakes. Not once – since it was set up in January 1999 – Adani Group has shown any desire to make his stake go up and make Wilmar the junior partner. He believes that businesses grow when competence marries enterprise. Currently, Adani-Wilmar is one of the top five players in the FMCG sector in India. It is the largest seller of edible oil. Even after 21 years the relationship survives and is thriving. There are hardly any non-compete agreements that he has asked his partners to enter, and he succeeds in maintaining relationships even if common sense might demand a re-evaluation of relationships.

Even in case of the MoU between the Adani Group and POSCO – it shows the strong relation he maintains with his partners. They agreed to explore business cooperation opportunities, including the establishment of a green, environment-friendly integrated steel mill at Mundra, Gujarat, as well as other businesses. The investment is estimated to be up to USD 5 billion. His connection with POSCO dates back to the time when the company has been involved with the Adani Group in building the 200-kilometre-long railway line in Australia. With this project, Gautam Adani got into the core of infrastructure building. He has got into steel-making. Going by the group’s track record, and an insight into the way the group thinks, this project could be a big exporter of steel in addition to supplying the metal for local consumption. And this project could propel group’s plans of becoming India’s largest player in green energy. Last year Adani Group signed a MoU with company for comprehensive cooperation for making high-grade steel, and for introducing carbon reduction technologies in India. POSCO had nightmarish experience of setting up steel plant in Odisha.

Healthy Competition

Besides the above, another factor which differentiates Gautam Adani from many other Indian industrialists is that HE DOES NOT BLOCK THE CHANCES FOR ANYONE TO GROW OR COMPETE with him. We have seen in the past that not only in India but globally industrialists would like to block the growth of competitors, Adani likes to push himself harder to grow faster than those who want to compete with him. Many will appreciate that this ability to push himself becomes an important ingredient of making him successful in such short time.

Business Aligned With National Interest

Another factor that makes him different from others is that he is of the firm belief that when a corporate group’s interests are closely aligned with national interests, growth can be assured. Now what we could understand, for Gautam Adani, nation-building means transforming India’s coastline by building a string of ports and logistics hubs. For him, nation-building also means strengthening the country’s energy security and mitigating the urban-rural divide by delivering electricity to several hundreds of millions living in the hinterlands of India. This remains the important ingredient of success along with, other management inputs, especially project implementation capability, finance and strategic vision. But ALIGNING WITH THE COUNTRY’S INTERESTS IS CRUCIAL. If we see his major business journey started with coal, ports, agriculture and logistics, and now with defence as well. There are times when ports, defence and national strategies get blended to give this group unusual advantages and heft.

Great Sales Skills

Gautam Adani is known for his sales skills. Once, when he visited the then Railway Minister Nitish Kumar, he successfully persuaded him about the importance of integrating ports with the railways and how it will benefit the country and the port owners. THIS LED TO THE FORMULATION OF THE FIRST NATIONAL PORT-RAIL LINKAGE POLICY. Because of this, the ports could link their terminals to the National Highway Grid and run their railway line to the nearest railheads.

Great Visionary

The greatest of Gautam Adani’s trait is a great vision, the most important ingredient for any business man to succeed. In July 2011, he employed Wolff Olins, an upmarket consulting firm, to make over the company’s image. Charles Wright, a member of the leadership team working on the project, said he is always careful before undertaking corporate brand building exercises ‘as we have to be sure that the management is serious as opposed to just wanting lipstick’. Stretching over more than six months, the Olins team conducted more than 60 interviews with the firm’s employees, including with Adani himself, before ‘getting down to crafting a vision of what the Adani Group should represent’. WRIGHT OFFERED A GLIMPSE INTO HIS THINKING: ‘GAUTAM ADANI MAY NOT BE THE MOST ELOQUENT OF OUR CLIENTS. BUT HE IS A RARE VISIONARY’.

At the time when the state of Gujarat was marked by minor state ports, Adani marketed to the state government the vision of how more ports would catalyse the state’s economy. When the government began to agree that what he was saying was right, he succeeded in getting the state of Gujarat to become a minority stakeholder in the Mundra port. When the government wanted to allot the port to the highest bidder, he was able to demonstrate his credentials which included a captive jetty and road. The result is that Gujarat’s port capacity has increased from 24 million MT in 1996 to 280 million MT in 2022.

The Mundra Port deal was exceptional in two ways. First, it was possibly the only deal where he had to buy a shareholder out. And second, this was a rare deal that was won without an open tendering process. The group’s defence deals would also fall into this category, because it is not possible to finalize defence deals based on tendering. The Mundra Port project was soon to become the cash cow for all his group’s activities.

The above factors make him an exceptional business leader and why he succeeded when others in same setup failed to perform. Gautam Adani is seen as one among the new breed of brash entrepreneurs projecting India’s newly modernised image to the world. And this could be the main reason why his group is connected to the darker side of this modernisation – the links between big business and government.

Hand in Glove with Government

Since ages, whether in India or in any other countries on the globe, especially in a developing country, business success requires good management of not only business but politics too. All businessmen cosy up to politicians. In the developed world this role is played by lobbyist groups. They specialize in liaising and putting the case of a businessman. It all happens openly and no one raises an eyebrow. But all such relationships can only help an entrepreneur walk some miles comfortably, cover the initial distance towards his goal and overcome some rules, but it certainly cannot guarantee success. There were some contemporaries of Adani who were politically equally connected, yet, they flopped commercially because they lacked other qualities.

Should you catch falling Adani stocks now?

Shares of Adani group of companies have fallen by more than 65 per cent on average and some of you might be tempted to go for bottom fishing. Nevertheless, we will analyse the situation independently of the current event to understand if these companies are investable at current price or not.

The sharp increase in the share price of Adani Group of companies is surprising for many. All the companies from the group represent sectors of the economy that have a longer gestation period. This dramatic boost in market capitalization happened at a family group built around infrastructure businesses, where investors have to wait for decades for payoffs, and often not driven to sudden changes in value assessment, which happened with Adani Group of companies.

We tried to understand the financials of the companies for the last ten years ending FY22. We excluded latest acquired companies of the group from this analysis. The company grew its revenues steadily and reported solid, albeit low, profitability in the first three years of study, however 2016-2021 time period after a major restructuring in 2015 that spun off Adani Ports, Adani Power and Adani Transmission, as separate companies, and the most recent year and a half (from March 2021 to September 2022), where the company reported a quantum leap in revenues. During that most recent period, the Adanis acquired a stake in the cement business, another capital-intensive and low profitability business, when they bought Hochim’s stake in ACC and Ambuja Cements.

While the revenue part of the story looks good, it is worth noting that through its entire operating history, the Adani Group has had low operating margins, with the trend lines in the wrong direction. While some of the decline can be attributed to the revving up of reinvestment in new businesses, it is also worth emphasizing that even when these investments start paying off, they will remain low-margin businesses.

Looking at the Valuation at glance, we don’t think that there is much doubt that the market was over stretched when it valued the Adani companies collectively at USD220 billion and Adani Enterprises at USD 53 billion. Valuation of Adani group of companies even with upbeat assumptions on revenue growth and operating margins, and without factoring any of the Hindenburg accusations of fraud and malfeasance, looked highly valued.

And even now, except for Ambuja Cement all companies look richly valued and should be avoided before any clarity emerges.

Valuation at Glance

| Mcap To Sales | TTM PE | |||||||

| Company Name | TTM_Date End | TTM_Net Sales | 24-Jan-23 | 24-Feb-23 | 24-Jan-23 | 24-Feb-23 | TTM EPS (Rs) | Industry PE |

| ACC Ltd. | 202212 | 17419.27 | 2.52 | 1.86 | 69.26 | 51.28 | 33.73 | 41.37 |

| Adani Enterprises Ltd. | 202212 | 130497.23 | 22.53 | 8.60 | 278.54 | 106.41 | 12.36 | 37.44 |

| Adani Green Energy Ltd. | 202212 | 6431 | 17.40 | 4.43 | 0 | -1.29 | 12.43 | |

| Adani Ports and Special Economic Zone Ltd. | 202212 | 18479.95 | 9.44 | 6.93 | 0 | -5.9 | 18.07 | |

| Adani Power Ltd. | 202212 | 39129.02 | 6.08 | 3.25 | 0 | -0.59 | 12.43 | |

| Adani Total Gas Ltd. | 202212 | 4551.56 | 24.53 | 4.76 | 852.07 | 165.31 | 4.56 | 38.75 |

| Adani Transmission Ltd. | 202212 | 12909.79 | 17.65 | 4.56 | 2,551.99 | 660.39 | 1.08 | 12.43 |

| Adani Wilmar Ltd. | 202212 | 59280.07 | 4.28 | 2.70 | 101.62 | 64.27 | 5.64 | 45.97 |

| Ambuja Cements Ltd. | 202212 | 30982.83 | 5.68 | 3.94 | 48.26 | 33.42 | 10.33 | 41.37 |

In conclusion, it seems that Adani Group might have played fast and loose with exchange listing rules, that it has used intra-party transactions to make itself look more credit-worthy than it truly is and that even if it has not manipulated its stock price directly, it has used the surge in its market capitalization to its advantage, especially when raising fresh capital.

Adani has just exploited some of the links in institution to its advantage but surely not played a con game.

TAKEAWAY

- A big bear cartel came and made money – rather looted and ran back. But anything is possible in India – the countrymen love extremes. However, whether the opposition likes it or not, but when we talk about India Growth Story Adani’s name will certainly crop up since the group is basically in infrastructure – the long neglected sector in Independent India.

- Adani Group alone is responsible for 7% of the capital investment by India’s 500 largest nonfinancial firms. A dominant operator of the country’s strategically important ports.

- The group is into Recession-proof strong business and nation building.

- Cement to give enough required stability – can be impacted only by news-specific fall, not company specific (last quarter, Ambuja was the star performer in the cement sector. The company’s cash and cash equivalent at the end of the quarter stood at Rs 9,454 crore).

- Adani Stocks moved due to fast growth as the numbers speak for themselves. And not to forget, price movement is affected by various factors – Tesla is trading from its 2021 $400 high to $200, and traded nearly $118 in January 2023. Year till date shares of Tesla is up by huge 90%, which helped its promoter Elon Musk to regain richest man in the world.

- Adani-led group is leaving no stone unturned to get back on track. The conglomerate commenced a series of investor meetings at Singapore, with the assistance of approximately twelve global banks. Investors were informed that the company is capable of fulfilling its obligations in the upcoming years and generating cash. After the news, shares of Adani Group are up by 10-70 per cent from its lows of February.

- Adani companies cannot be compared to other beleagured companies such as DHFL, HDIL, Unitech, or ADAGs.

- Adani companies completed Rs 15,446 crore secondary equity transaction with US PE firm GQG Partners via block trades on March 2.

And Enters George Soros

Born in Budapest to Jewish parents the 92-year-old hedge fund manager-turned-philanthropist George Soros is known to make controversial statements. And he, midway through a speech ahead of the Munich Security Conference, touched upon the debate over Gautam Adani’s business empire and the market selloff in Adani group stocks in the wake of the Hindenburg Research revelations.

There was nothing wrong to comment, but his words that “it may open the door to a democratic revival in the country” made headlines, and for the right reason.

He said: “India is an interesting case. It’s a democracy, but its leader, Narendra Modi, is no democrat. Inciting violence against Muslims was an important factor in his meteoric rise. Modi maintains close relations with both open and closed societies. India is a member of the Quad, which includes Australia, the US and Japan but it buys a lot of Russian oil at a steep discount and makes a lot of money out of it. Modi and business tycoon Adani are close allies and their fate is intertwined. Adani is accused of stock manipulation and Modi is silent on the subject, but he will have to answer questions from foreign investors and in Parliament.”

And he didn’t stop. He said, “This will significantly weaken Modi’s stranglehold on India’s federal government and open the door to push for much-needed institutional reforms. I may be naïve, but I expect a democratic revival in India”.

Rightly, Soros is well-known as a manipulator of democracies around the world.

Remembering Dhirubhai Ambani: Even, Dhirubhai Ambani was accused of political manipulation. And the optics he created cemented this belief. There is absolutely no secret that he successfully used his self-created association with politicians, right from the top. And he did it wonderfully. A common Indian has no grudge rather he is amazed. After all without connections one cannot get even a contract of few thousand rupees in this country. So everyone is in this game – and the truth is all out in the open.

Dhirubhai became a cult figure, a much-respected and adored personality, despite using all the tactics. Those involved in moral policing, in fact, have no guts to venture out and do something that provides jobs to millions that creates national assets, so they are unaware about the problems a first generation entrepreneur faces in this country.

For a newcomer like Dhirubhai to beat the old giants at their own game signified immense talent. Something similar can be said of Adani. Ambanis might have got favours when the group entered in telecom but the success was not guaranteed with that. It came with the vision and its successful implementation and the execution – can one deny that they created the cheapest telephone network in the world? Those who focus only on the manipulation part are blind to the phenomenal skills that made Dhirubhai a historical business titan. Everyone wants to copy his style because there is no other way. And it is the fault of the system.

Adani is treading a similar path. Critics say Adani deals mainly in infrastructure where coziness to the government matters more than true skills. History shows otherwise. Why should we forget – there were some south based business tycoons with strong regional political clout who joined the infrastructure boom of 2003-08. But despite having political protectionism, many ran into trouble and went bust.

Success in infrastructure requires skill, not just political friends. Gautam Adani has a business instinct for risk-taking but also knows how to play the system of Indian politics smartly– making friends in high places and using political connections to his benefit.