Rise of Indian Tech Giant?

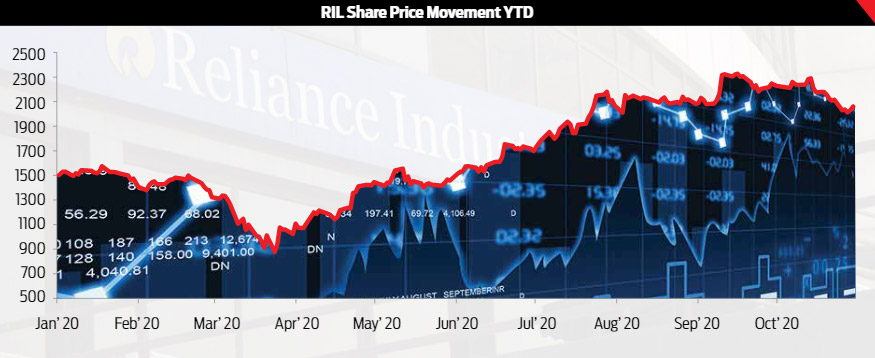

The share price of now retail to refinery conglomerate, Reliance Industries Limited has more than doubled since the lows of March 23, 2020. Such a spectacular rise in the RIL’s share price helped it to cross the market cap to Rs. 16 lakh crore, the only company in India to achieve this feat. This mammoth increase in the company’s market cap has made its biggest shareholder, among the top five richest men in the world. When the entire nation was reeling under the lockdown due to coronavirus, it is estimated that Mukesh Ambani, the chairman, managing director of the company was earning Rs 90 crore every hour (no typo error).

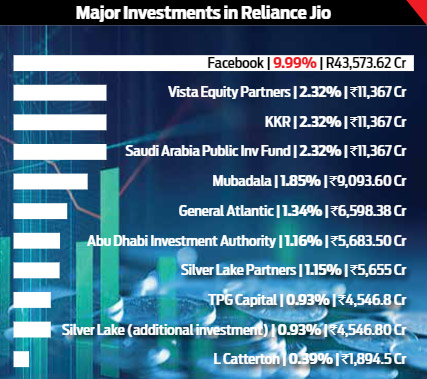

This was achieved after the value unlocking in its telecom and retail business, however, the majority of that came from telecom segment. The company was able to raise around Rs 1.52 lakh crore from tech giants such as Google, Facebook, and others in return for about 33 percent of share in its telecom segment. Jio Platforms, a subsidiary of Reliance Industries is just a four-year-old company and attracted so much capital so quickly that while the rest of the world is focused on a global pandemic, Jio Platforms suddenly has appeared in the global arena as the first global tech giant to get its start in India.

Around Rs. 13,000 crore came from the sale of a stake in retail venture. The valuation at which these investments were made led to a spectacular rise in the value of the entire company. But what was so interesting and attractive about the company that it gathered so much attention.

Little Bit of History

One of the reasons investors were falling upon each other to have a pie of Reliance Jio because they do not want to miss the opportunity provided by the world’s second-most populous country. From its inception in 1970s by the founder Dhirubhai Ambani, the company is known to have clearly direct access to maneuver through the labyrinth of government regulation and taking advantage of ambiguous and lax regulatory processes and systems of oversight. Companies such as Amazon and Walmart-controlled Flipkart, which are operating much before Reliance Jio made entry into retail and e-commerce, are now being investigated for antitrust violations. This might weaken them which will be beneficial for Reliance Industries. So these big tech companies such as Facebook and Google who invested in Reliance Jio know how the company they are investing in is adept at working the Halls of Power in New Delhi and hence they may not face any such problem that other companies from the same country are facing.

Otherwise, a company like Reliance Industries would have been untouchable by foreign companies, looking at its history. In April 2006, US oil major Chevron bought a 5 percent stake in Reliance Petroleum (now merged with Reliance Industries), with an option to increase it to 29 percent. Three years later, Chevron did not exercise that option and exited at the same price it entered at. Similarly, when Reliance Industries Limited was trying for backward integration and diversified into oil and gas exploration, it offloaded a 30 percent stake to BP in 23 oil and gas blocks for a total deal value of USD 9 billion. Another 10 percent was offered to Canadian company Niko Resources. Those oil and gas wells did not turn out as projected and both the partners for their own reasons exited with loss and wrote off of their investments made.

Why History May Repeat Itself

This time also the story may repeat itself and foreign investors may not get the returns they are expecting. Facebook till now remains the first and the largest foreign investor in the Jio Platform. The reason they selected Reliance because it is the biggest telecom company in India in terms of market share. They saw synergy by associating with them as Facebook wants to leverage the dominant position of Reliance to continue its dominance in the online ad space. For this, Facebook may acquire personal information of Reliance Jio’s clients going ahead. Although, privacy policy on Reliance Jio’s website reads that the company doesn’t sell or rent personal information to any third party entities, however, the company limits the disclosure of personal information to certain circumstances such as mergers or acquisitions that affect the company and also to its partners. This may be construed that if required it may share private information with its partner.

What gives credence to such a possibility is the concern raised by Justice BN Srikrishna, chief architect of the personal data protection framework. He raised concerns over the lack of a data regulator to oversee privacy concerns emanating from the Reliance Jio-Facebook deal.

The reason the deal saw the light of the day because there is no data privacy law in India. This does not mean that it will never be. Going ahead we may see data privacy law coming into force in India and protect the private information of citizens of India and bar any telecom company to share private data of its customers.

The reason we attach more probability of happening this because of the difference in opinion between Facebook and the Indian Government on data localisation. Indian government wants all the data to reside in India while Facebook may not share the same view. This is vindicated by a statement issued by Facebook India’s VP and managing director who said that “We hope the future data protection regime protects consumers and also boosts the ease of doing business in India”. He further added that Facebook believes that unrestricted free flow of data is the bedrock of an open market.

Besides data, Justice Srikrishna also pointed out that the Jio-Facebook deal may also raise concerns related to competition law. However, he is assured that the anti-competitive regulators, upon a complaint being made, will investigate facts while looking into various aspects of the deal and following due process of law and finally come out with a conclusion. All this may put spoke on the company’s future plan and may meet the same result that other foreign partners faced.

Current Valuation of RIL Assumes Flawless Execution

The current valuation of Reliance Industries assumes that everything will fall in place and there will be a flawless execution of its plan. Nonetheless, the recent clash between the world’s two wealthiest men Mukesh Ambani and Jeff Bezos for the stake of Future Retail shows the complication of execution and obstacle it may face in unfolding its retail plan. Reliance intends to purchase Future Retail’s assets while a Singapore arbitration court restrained Future from going ahead with the transaction. Reliance had agreed to buy Future’s retail, wholesale, logistics, and warehousing units for USD 3.4 billion. Therefore, one should not be surprised if legal proceedings are to be initiated in Indian courts from Future and Amazon. This will only delay the execution plan of Reliance Retail.

Therefore, we see a black cloud of execution risk lingering over the Company’s two major growth engines that is Digital and Retail Services. They are already priced for perfection and any deviation will put extreme pressure on the company’s share price. The second-quarter result of FY21 clearly exposes the company’s soft belly.

Q2FY21 Exposes Company’s Soft Belly

In its Jio and Digital Services, net subscriber addition slowed down to eight million for the quarter ending September 2020 compared to its main rival, Airtel adding 14 million. There was higher churn at its lower-end customers especially migrant laborers. The average revenue per user (ARPU) too saw a modest increase on a sequential basis to Rs. 145. Nonetheless, it is a deep discount to its main rival BhartiAirtel, whose ARPU stood at Rs. 162 in the same period.

On the retail front, there was no update provided by the company regarding the pending Future Retail acquisition, which remains a cause of concern about things will progress. The performance of retail division otherwise has been positive. While revenues and EBITDA should continue to improve from here, given the nature of the pandemic, footfall recovery especially for the Fashion & Lifestyle segments could take time. The company highlighted that while retail footfall is improving it remains below pre-COVID levels.

The Refining Segment remained the key drag this quarter with reported GRM’s falling to USD5.7 per barrel a level that we last saw was in the year 2009. Every USD 1/b refining margin still impacts the group’s EPS by around five percent. This is despite Retail and Telecom being the growth engine of the company for last few years.

The Chemical Division of the company failed to provide the usual production mix and margins for its key end-products. Although this division of the company saw better than expected sequential results, in the absence of any detail, analysts are attributing it to inventory gains or favorable Naphtha and Propane pricing from the refinery-gate. Hence, this again raises a concern about the continuation in the improvement of the situation for this segment and it will take some time to reach normalisation.

Why we believe RIL will remain an underperformer

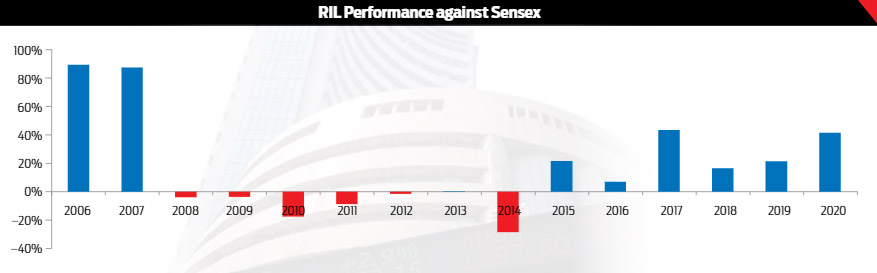

Higher valuation, weaker operating performance, and strong competition will check further rise in the share price of the company. Historically, we have witnessed Reliance Industries outperform for a few years after that it remains quiet for a long time. The adjacent graph shows the yearly performance of the RIL’s share against Sensex. It is clearly visible that after outperforming in years 2006 and 2007, shares of RIL underperformed for the next seven years.

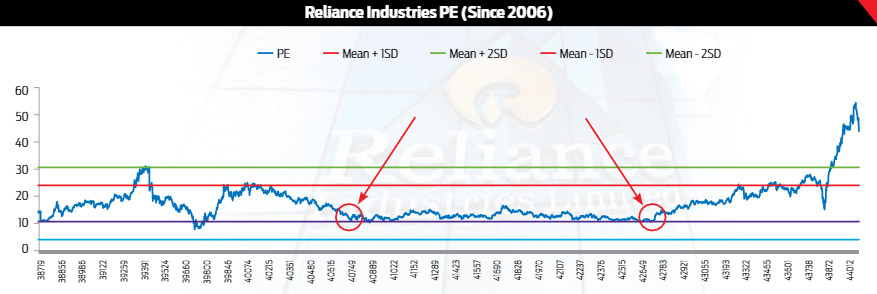

We may see it happening that again, especially, if we look at the valuation at which Reliance Industries Limited’s shares are available. The next graph shows the trailing price to earnings (PE) ratio of RIL. It is now trading at a PE of more than 40x, which is more than two standard deviations higher than its long-term average.

Therefore, we see the beginning of the end of RIL’s share price outperformance and for the next couple of years, it is going to be an underperformer. The only thing that can prove us wrong is a large deal with Saudi Aramco or selling a good chunk of its retail business to some big player.

Currently, we do not see either of that happening, and hence better to Exit the Stock.